By: Matt Fanning

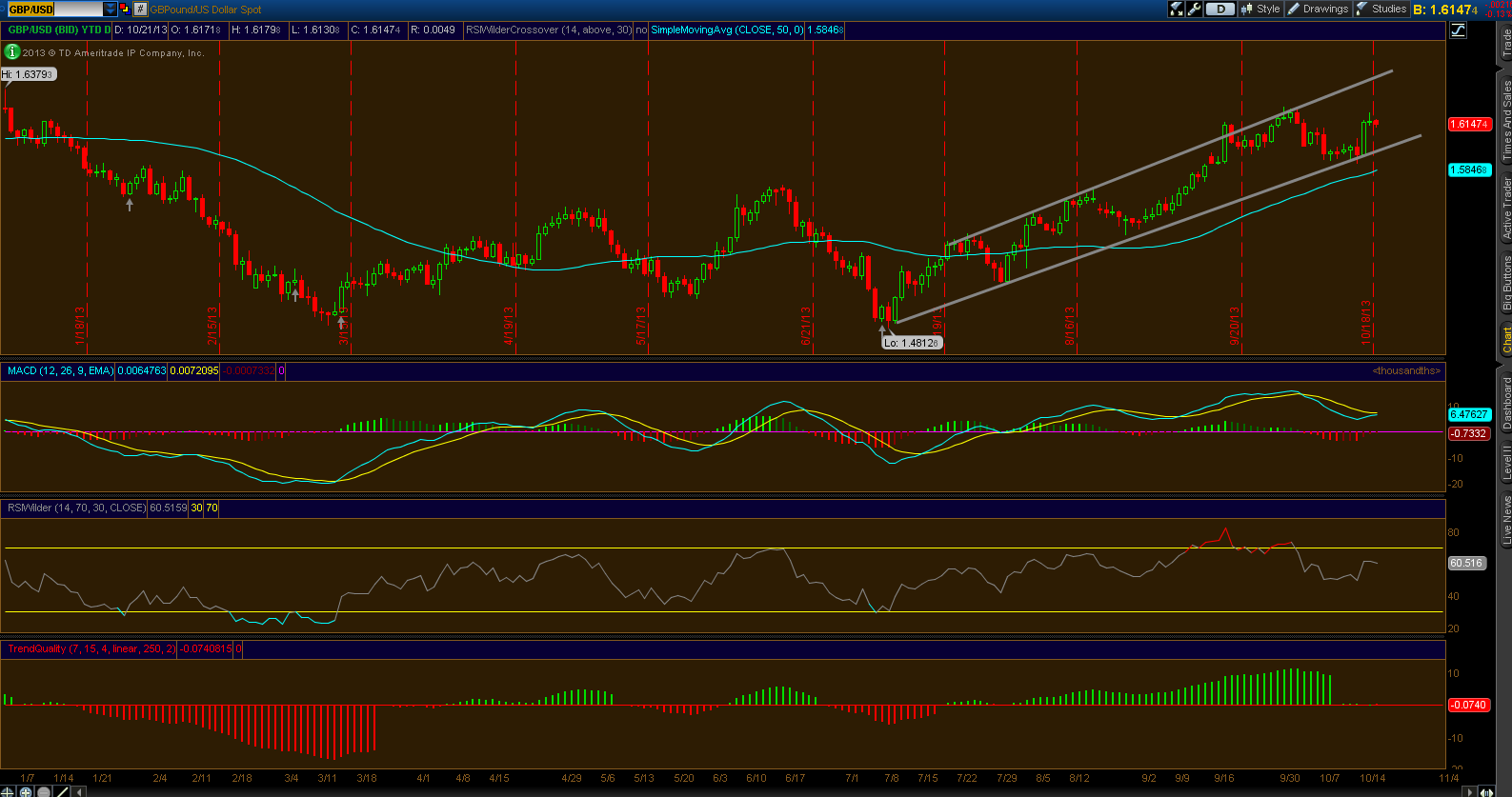

Lately there has been a lot of discussion around if the Pound is topping out against the US Dollar. Looking at the Technicals on the GBP/USD Pair, it is currently within a defined uptrend channel since July, from 1.48, with a current top around 1.62. That is one of my few bull cases though, as I am currently bearish on the pair. Within that up-trend, there is some failure occurring within the trend back up to its upper band. Friday, the candles put in a top/bearish doji, and so far today, the pattern is confirming with followed-thru downside.

MACD made a bearish crossover on 10/4, which led to support at 1.5949, which held the current up-trend. The divergence is still in bearish territory and needs upside to make a bullish mark, and so far the decline today will only move the MACD negative. RSIwilder topped out 9/18, when the pair had a strong upside day, closing at 1.6143, and has been on a bearish downtrend ever since. This level also sets up the first phase of a Head-and-Shoulders pattern, marking the first shoulder.

Looking at the last few sessions, you can see symmetrical upside on 10/17, starting to complete the second shoulder on that pattern, with the head being the current top at 1.62. Lastly, there is been a dramatic change in the pair’s Trend Quality. From the up-trend that began in July began an extremely strong trend, and then began weakening in the beginning of October, printing lower high after lower high. Since 10/11, the bull trend aligning with the pair’s performance has come to a halt, and has been flat/indecisive since.

Trade Idea: Short the pair and use the daily high in that Head-and-Shoulders as your stop, 1.6259, and would target 1.590 to take profits. More extreme, if we can’t hold 1.59, 1.56 is the next level the pair could test.