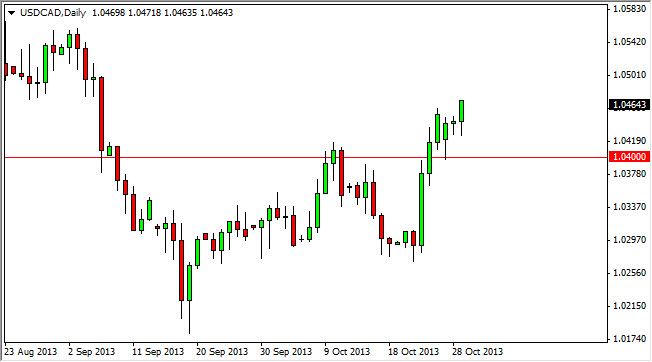

The USD/CAD pair initially fell during the session on Tuesday, but bounced by the end of the day in order to form a bullish candle, and a fresh, new high. This of course is bullish, and as a result I think this pair should continue higher. In fact, I think the 1.05 level will be targeted first, and then the 1.06 level. This area leads to the 1.10 level in the longer-term, and I think that the move above 1.06 could even be swift, as this pair tends to tread water for a long time, and then suddenly takes off. This is quite common in interconnected economies like these two, leading to the pair being a bit tricky to trade at times.

The Canadian dollar of course will continue to be influenced by the oil markets as per usual. Also, the jobs numbers will come into play out of America as it influences the amount of buying that Americans do of Canadian exports. The housing sector of course has an influence as well, as much of the lumber supplied to the US comes from the Great White North as well.

Technical pair

The USD/CAD pair tends to be very technical as well, and as a result I tend to pay a lot of attention to it. This being said, I see quite a bit of support at the 1.04 level, and I think it is now the “floor” in the market, offering massive support to the US dollar at that level. On the upside, I see the 1.05 level as being crucial, but not as important as the 1.06 handle, as it will give this market the felling of a beach ball finally breaking the surface of the water after being held down – this market will more than likely explode higher, probably going parabolic at that point.

As for selling, I see far too much in the order of support below, and as a result I don’t even really a scenario where I would be short of this market. Truthfully, I feel it has support all of the way down to the 1.0250 level.