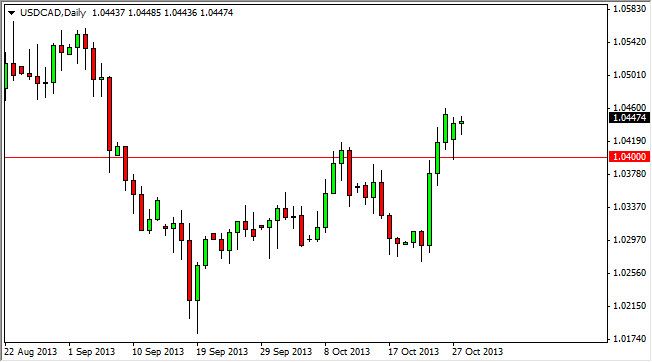

The USD/CAD pair fell initially during the session on Monday, but as you can see bounced in order to form a hammer. This hammer of course signifies that the 1.04 level should offer support going forward. A break above the top of that hammer is reason enough to think that this market goes to the 1.05 handle, which of course is another move towards resistance. If that area does not hold as resistance, I suspect that the 1.06 level will be targeted next, which would more than likely open the door to the 1.10 handle if we can get above that.

With that being the case, I feel that this market should go higher over the longer term, and I do think that there will be a bit of a fight between now and that level, which will cause choppiness in this pair going forward. That is a common occurrence in this pair, as it does like to chop around going sideways, and then shoot in one direction or another in a violent manner. That is because these two economies are so interconnected, which of course means that the status quo is a lot of back and forth.

Watch the oil markets as well

Watch the oil markets as well, as they are approaching the support level. Nonetheless, I do think that eventually the Canadian dollar will react to the oil markets as it typically does, as well as the nonfarm payroll numbers on Friday. Ironically, this pair tends to rise when the jobs market in America is poor, simply because the Canadian send 85% of their exports into the United States. That being the case, we need to see plenty of jobs in the United States in order to buy the Canadian exports. That's why a poor jobs number actually hurts the Canadian dollar, as Canada is so heavily dependent on the Americans. That being the case, I feel that this market could do a little bit of a sideways job between on Friday, but rest assured that this pair will more than likely move drastically on Friday.