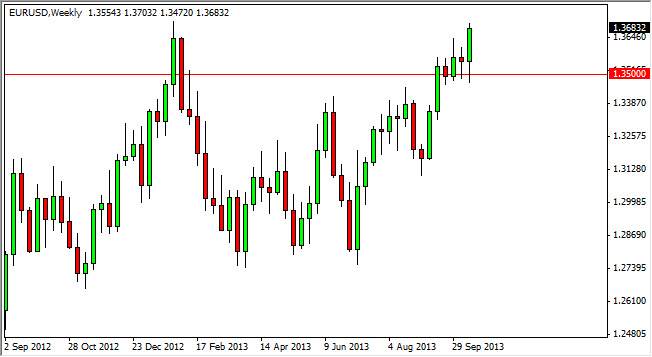

EUR/USD

The EUR/USD pair fell back towards the 1.35 level during the past week, but found it to be very supportive. The Federal Reserve board member Evans said that the Fed will more than likely need to see several months’ worth of data before the members could think about tapering off of quantitative easing. This of course is bad for the Dollar, and as a result the Euro took off against the Dollar. This candle looks strong, and as a result I think that the market will continue higher. In fact, I think pullbacks will be buying opportunities, and we will eventually hit the 1.40 mark.

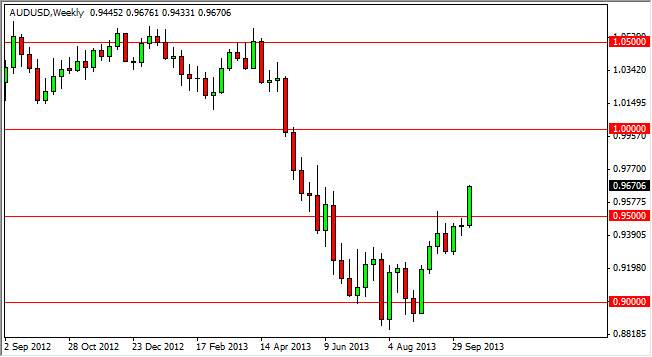

AUD/USD

The AUD/USD pair broke above the 0.95 during the week because of the above mentioned comments about tapering. The candle broke higher, and closed at the very top of the range. The market looks like it’s going to head towards the parity level, and as a result I am long of this pair due to the breakout. Pullbacks will be used for entry points for traders to step into the markets. Watch gold markets as well, as they should continue to lift the AUD/USD pair.

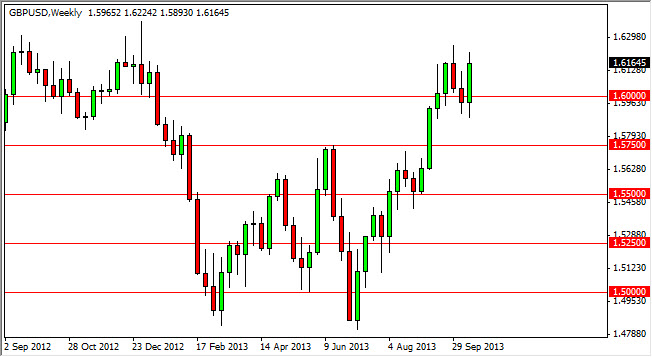

GBP/USD

The GBP/USD pair also rose, braking above the 1.60 handle solidly. The pair seems to be trying to break higher than the 1.62 level, an area that has been resistive in the past. However, it seems to only be a matter of time before the markets break out and higher. The 1.65 level will attract the markets as it is the next major resistance level. The pullbacks will be used for buying opportunities, just as the EUR/USD and AUD/USD pairs.

USD/CAD

The USD/CAD pair fell over the course of the last week. The pair found the 1.0290 area supportive, and it appears that the pair simply cannot breakdown at the moment. The hammer that was formed a few weeks ago shows me that the markets are ready to go back and forth in a 100 pip range. Because of this, expect to see choppiness in the short term as the two economies are so interconnected. In fact, until we get the nonfarm payroll numbers, this pair will be dead money in my opinion.