EUR/USD

The EUR/USD pair rallied most of the week, but as you can see failed at the 1.36 level, and formed a pretty significant shooting star sitting right on top of the 1.35 handle. While there is support just below this candle, one has to think that this market will more than likely pullback, and that makes sense given the fact that the nonfarm payroll number never came out on Friday, which gave the US dollar a little bit of a break. After all, no news is good news. Nonetheless, any pullback from here will more than likely meet support somewhere around 1.34, and simply offer another buying opportunity.

AUD/USD

The AUD/USD pair rose during the week, but as you can see stays below the 0.95 handle, an area that I believe is going to be very resistive. This is based upon the shooting star from two weeks ago, and the fact that there is a cluster just above that level also. With that being the case, I think that this pair will probably wipe out a lot of accounts of the next couple of weeks because there is support below. That being said, if we can get a daily close above the 0.9550 handle, at that point time I would consider going long and aiming for parity. As far as shorting is concerned, I'm not quite comfortable until we get below the 0.93 handle, and recognize that there is support below there as well so it would be a choppy trade.

USD/CAD

The USD/CAD pair stayed in a relatively tight range during the week, which makes a lot of sense when you think about the fact that the nonfarm payroll numbers never came out. That announcement is especially decisive in how this market plays out quite often. That being the case, I think that this market will move eventually, but we need to get the US government working again. Nonetheless, I see quite a bit of resistance above at the 1.04 handle, so we need to get above there on a daily close for me to be comfortable going long. As far as shorting is concerned, a break of the hammer from two weeks ago to the downside would probably be enough to aim for parity at that point.

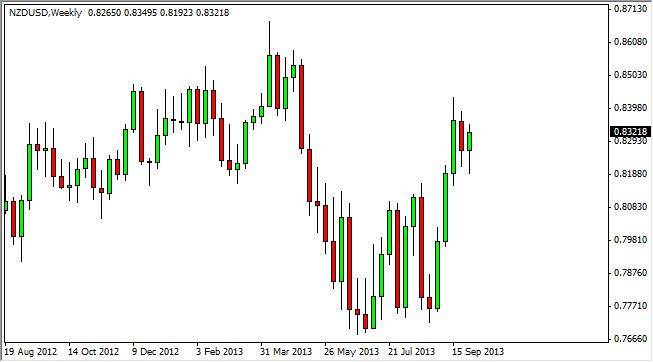

NZD/USD

The NZD/USD pair fell initially during the week, but found a bit of support close to the 0.82 level. The resulting bounce formed a hammer, and this suggests to me that the Kiwi will more than likely continue to be bid, and that the market is probably trying to get back to the 0.85 level. This could be a choppy move, but I think this is where we end up shortly.