The AUD/CAD pair continues to fall over the longer-term, and I think December will see more of the same. The reason I am doing analysis on this pair is that it is so useful when it comes to others markets. A futures trader will do quite well to pay attention to it, as it essentially is a battle between two of the larger futures markets, gold and oil.

The Aussie dollar of course is highly influenced by the gold markets, while the Canadian dollar is influenced by oil. The fight between the two can be used to decide which market to buy overall. After all, the US dollar can move both of these markets, and this currency pair can be used to determine relative strength. If the Aussie is falling as it has – the gold markets should underperform the oil markets.

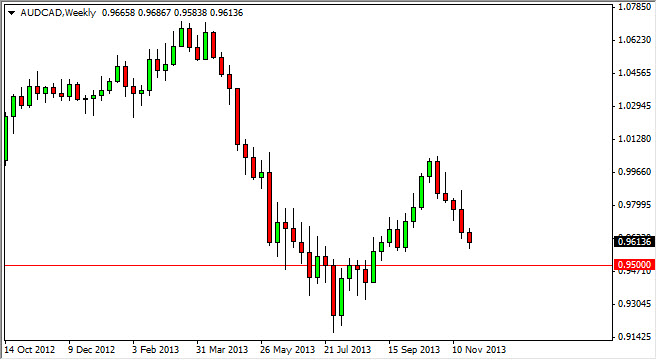

0.95 level

The 0.95 level should be somewhat supportive, but I think the gold market is in serious danger of falling hard. If it does, this pair should continue the downtrend. This would go well with the longer-term charts, and as a result I think this pair can be sold right away if you a long-term trader. However, this level could cause a bit of a bounce, but it will eventually give way to the sellers as it has already been broken through in the past and there is no reason to think it won’t happen again.

The 0.90 level is where this pair is going in my opinion, as this pair typically will follow the AUD/USD pair as well. It’s essentially a play between the Aussie and North America at that point, and I think the world is much more comfortable investing in the Americas than it is in the Pacific and Asia, which the Aussie represents.

Technically speaking, I would expect the pair to find support at the 0.90 level, and a bounce could be significant. Because of this I would be taking profits in that region, but looking for a resistive candle off of the bounce in order to start selling again.