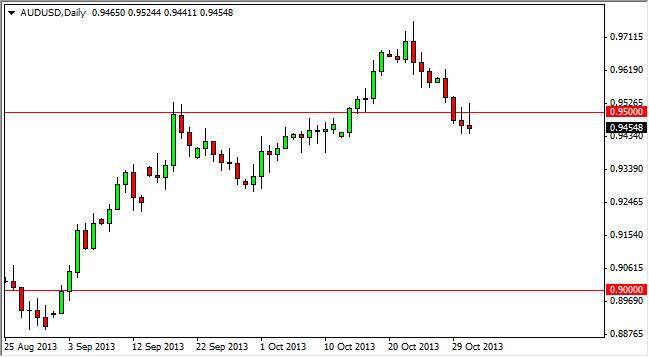

The AUD/USD pair tried to rally during the session on Thursday, but as you can see the 0.95 level offered far too much resistance yet again and as a result force this market to form a shooting star. That of course is a negative sign but we also have to keep in mind that there is quite a bit of noise below at the same time. This noise should keep the market somewhat afloat, and because of that I am very hesitant to start shorting the Australian dollar at this point. Quite frankly, it's going to be very difficult to short the market until we get below the 0.9350 handle, where we would have cleared a lot of the noise going lower.

On the other hand, if we break the top of the shooting star from the Thursday session, that is a positive sign. I would be willing to buy the Australian dollar above there, and aim for at least the 0.97 level, if not parity which I believe is what the market is going to do over the length of the move.

Gold markets fell during Thursday, and this could be a sympathy move.

The gold markets fell fairly hard during the session on Thursday, perhaps causing a sympathy move in this particular market. However, I believe that the Australian dollar does have a decent chance of being much stronger over the long-term, but it would depend on what traders around the world choose to focus on. After all, if they focus on weaker global demand, then the Australian dollar should struggle to go higher. However, if they focus on the fact that the Federal Reserve cannot taper off of quantitative easing, it's likely that this pair goes higher. I believe that it will be the latter of the two possibilities, and as a result I'm waiting for break of the top of the shooting star in order to start buying again. I fully expect to see that happen, but we could see a little bit of downside pressure between now and that point.