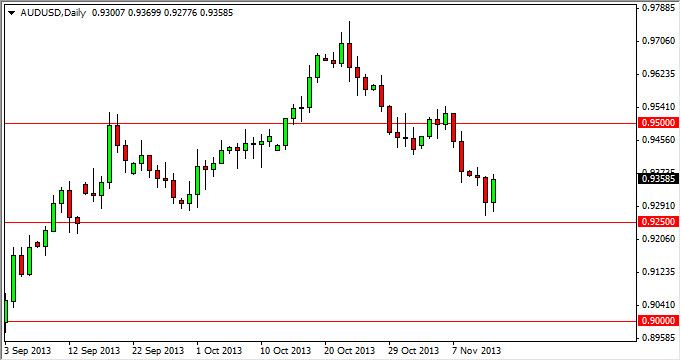

The AUD/USD pair rose during the session on Wednesday, showing the 0.93 level be supportive yet again. As you can see on this chart, I have a line drawn on the 0.9250 level, which has been supportive in the past for the Australian dollar. However, during the session on Wednesday we see the gold markets take a bit of a move lower, and that has me concerned about the Aussie dollar itself. With that being said, I think that this market although it seems to have a little bit of an upward bias, could be one of the more difficult ones to trade in the short term. Really, we have a fairly obvious consolidation area between here and the 0.95 level, but a lot of that's going to depend on global growth numbers, which haven't exactly been strong.

All things being equal, I do believe that the Australian dollar should strengthen over time, but we have to get gold markets moving in the right direction. Also, pay attention to Asian economic numbers as the Aussies supply so much in the way of raw materials. If they do not pick up, the Australian economy will suffer.

Possible head and shoulders?

One thing that I do find interesting about this chart is that a return trip to the 0.95 level could actually be the right shoulder of a particular pattern known as the "head and shoulders" pattern. This of course is very bearish, and by my measurements would have the market falling to roughly 0.88 or so over the longer term.

One scenario where this would be very likely is if the Federal Reserve does in fact look like it's ready to taper off of quantitative easing. While that could be the case, it doesn't seem like it's going to happen right away, and we do have a new Federal Reserve Chairwoman coming into play by the name of Janet Yellen. For those of you who don't know her, she's probably one of the few people on the planet that is more dovish than Ben Bernanke. Because of this, confusion reigns yet again...