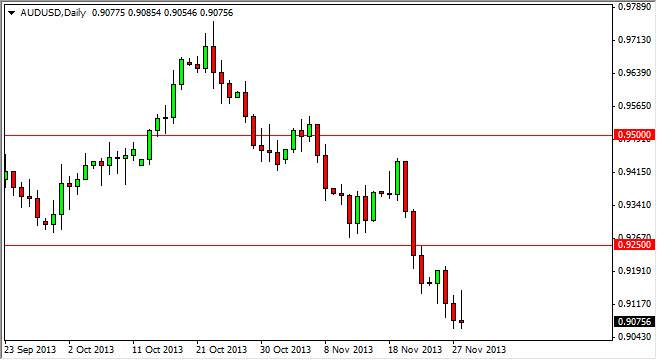

The AUD/USD pair tried to rally during the session on Thursday, as the Americans were away at Thanksgiving holiday. However, you can see that the buyers got blown out, and the market ended up forming a shooting star. This shooting star sits right on top of massive support at the 0.90 handle, so I am very hesitant to start shorting this market until we get below the 0.90 handle, or perhaps shorting some type of rally from this level. Any rally that shows signs of weakness from here is a decent sell signal as far as I can tell, and I will treat it as such.

Gold markets look a bit soft at this moment time, and as gold and the Australian dollar tend to move in tandem, it makes sense that we will see continued weakness in this market. However, much like this pair, the gold markets have a significant amount of support just below is well. With that being the case, we could see a little bit of a bounce in the short term, but I think that is only going to invite sellers to jump into the market and take advantage of what is obviously a very strong downtrend.

0.93

The significance of the 0.93 handle is the fact that we need to close on the daily chart above that level in order for me to consider buying this pair. We are a long way from there. At the moment, and quite frankly I would be surprised if we got above that level. If we did, I would have to essentially give up on the short side, and simply follow the market which is essentially what you should be doing at any given moment anyway.

If we close below the 0.90 handle, I think this market will next head to the 0.88 handle, and then possibly the 0.85 handle below there. I would expect a pretty sizable fight at the 0.88 handle based upon longer-term charts though, so more than likely I would simply take profits just above that level, and be happy with that