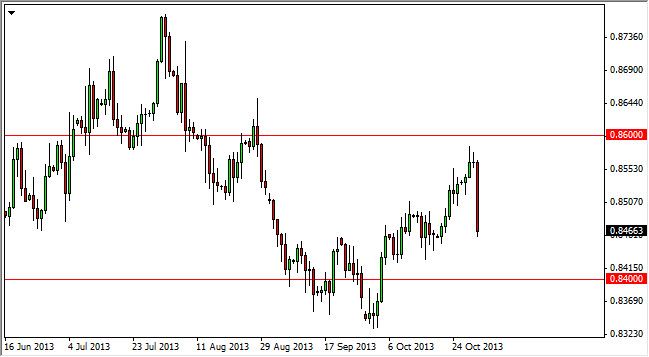

The EUR/GBP pair fell hard during the session on Thursday, breaking down to the 0.8450 level. It was enough support there though in order to keep the market somewhat afloat, but you have to look at this candle and understand that it closed at the very lows of the day. This is a very bearish candle and a very bearish sign. Because of this, I think this pair could see a little bit more weakness ahead, and when you look at the way that the Euro performed against the Dollar, which was very poor, against the way the Pound performed against the Dollar, which was fairly benign. That being said, the Euro is most certainly weaker than the Pound overall.

There is a significant amount of noise just below the current level, and because of that I think that the 0.84 level will continue to be supportive. I'm looking for some type of supportive candle down here, and will be buying it as soon as I see it. However, I recognize the fact that with the candle being so long and red, it certainly might take a while for the buyers stepped in and push his market around to the upside.

Range bound market should continue.

I believe that the range bound market should continue, basically between the 0.84 level on the bottom, and the 0.86 level on the top. Because of that, I can see that this market will continue to be more or less a short-term traders market, and as a result traders should take profits as quick as they can. I think the average trader will probably be more or less happy with 60 and 70 pips gains. Anything beyond that is probably going to get you in trouble, because of the choppy nature of this market. In fact, this market is typically choppy, and because of that you have to be very careful about how much you put into the market. On top of that the PIP value is higher than the average pair, so of course it takes less movement to make money, which is why the markets tend to be so choppy in my opinion.