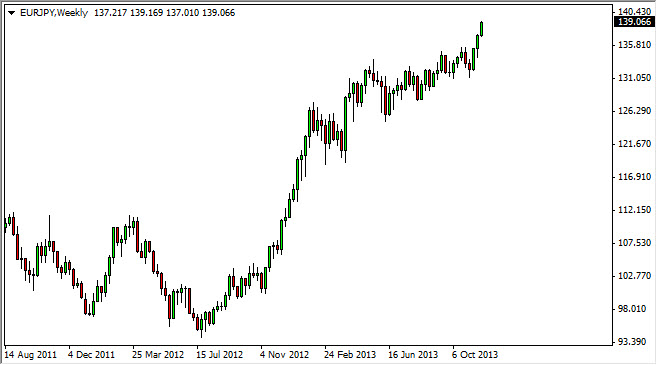

The EUR/JPY pair has been on fire lately. Because of this, I certainly cannot advocate selling it at all, and as a result I won’t even entertain a short position – no matter how parabolic the market gets. This market is largely driven upon the sentiment of global markets in general, and because of this I will watch several stock indexes across the world in order to get a “fell” of what this pair should do. I will often watch the New York indices, the DAX, the FTSE, and the Nikkei. If they are all going higher, generally this pair will as well.

The recent breakout is somewhat strong, and somewhat parabolic for that matter. This has me thinking that the pair will more than likely pull back during the month of December, but this will ultimately just be a nice buying opportunity. The market should see a lot of support at the 135 level, and this area would be a perfect level to buy supportive candles at. However, we might not even get that chance, as this pair looks ready to fly.

The pullback could be because of….

The pullback that I expect to see sooner or later is very likely going to be in part due to the lack of liquidity that this pair and others can see during the month of December, particularly in the second half of that month. After all, most of the Western world will be closed for Christmas and New Year’s, so it is difficult to imagine that the markets are going to move much during that time – there just isn’t enough firepower in the Middle East to move the markets for any real length of time.

The 140 level above could also cause a pull back, and this would be of the temporary type as it is a large round psychological number. This is a “natural” place to see sellers, or at least profit taking. As for myself, I am simply waiting for some kind of pullback in this pair in order to bring “value” to the table. I will use the daily charts to spot support after the fall, and start buying.