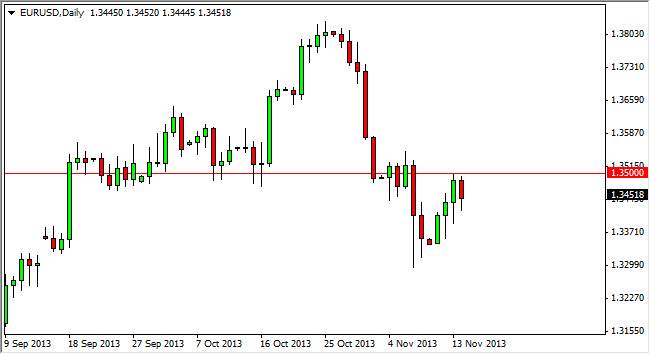

The EUR/USD pair fell from the 1.35 handle again, showing that the area is in fact going to be rather significant resistance. This doesn't surprise me although, as it was such a significant support area previously, and therefore it should show some type of strength on the return trip. The candle that formed for the Thursday session is a little bit of a hammer, so shows a continued pounding against this resistance area. That being the case though, I still believe that the market is going to be more about the Dollar than the Euro, and whether or not the Federal Reserve will be able to taper. I've been talking about this for some time now, but unfortunately the markets are essentially just focusing on that one particular situation it seems.

The 1.35 level has been historically significant, so there's no reason why this should continue to be. Even if we broke above this area, I believe that we will more than likely consolidate between 1.33 on the bottom and 1.36 on the top as it looks likely that this area is going to continue to attract traders on both sides of the fence.

Federal Reserve and possibly European economic numbers.

As I said before, the Federal Reserve and whether or not he can taper off of quantitative easing will without a doubt be a major factor in this market, but you also have to pay attention to the European economic numbers as the surprise rate cut certainly has the market wondering what the ECB is seeing. After all, several banks do not do rate cuts on signs of good economic moves. Because of this, I feel that the Euro will suffer over the longer term. However, there are enough questions out there that consolidation makes sense at this point, plus if you keep in mind that there was a pretty significant selloff just a couple of weeks ago.

This market continues to chop around in my opinion, and therefore will be very short-term oriented, as it has been over the last couple of years.