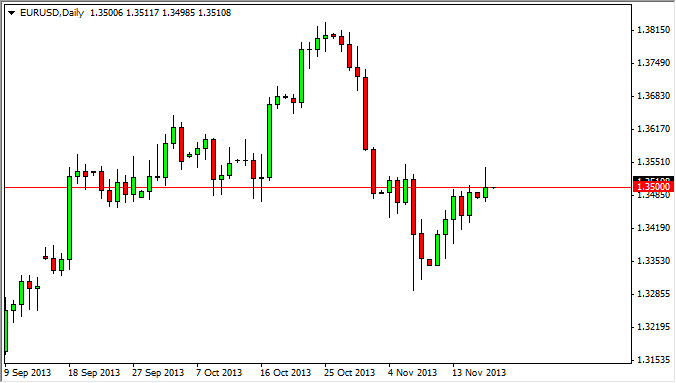

The EUR/USD pair broke higher during the session on Monday, but as you can see failed above the 1.35 level as the resistance continues to hamper the buyers and keep them at bay. The 1.35 level has been fairly significant in its importance recently, as well as long-term as the area has both served as support and resistance.

The market falling back down and forming a shooting star of course is very negative, but we also have some hammer like candle just below. That being the case, I feel that this market is going to struggle to go anywhere at the moment, and we may be seeing this market, bouncing around the 1.35 handle. On a larger scale though, I think that the support of the larger consolidation will be found at the 1.33 handle, as well as the resistance level above at the 1.36 handle will make this market somewhat choppy for the interim.

Questions about the Federal Reserve, and the ECB.

There are questions about the Federal Reserve and what they are getting ready to do. After all, if they can taper off of quantitative easing, that would be very positive for the US dollar. However, as you can see the market has been going in the favor of the Euro, and while that is Dollar-negative, the reality is that it simply a return to where the Euro had fallen after the surprise ECB rate cut.

With that being the case, I feel that the markets are simply trying to weigh out what's about to happen on both sides of the Atlantic. Looking at the technical set up though, if we can break down below the 1.3450 area, I think this market will fall the way down to the 1.33 level in relatively quick fashion. There is a gap down there that could offer support yet again, but if we can get below that area, I think the next move is down to the 1.30 handle. On the other hand, if we break above the 1.36 level, I think that we go all the way to the 1.38 level without too many issues either. Expect a lot of choppiness either way.