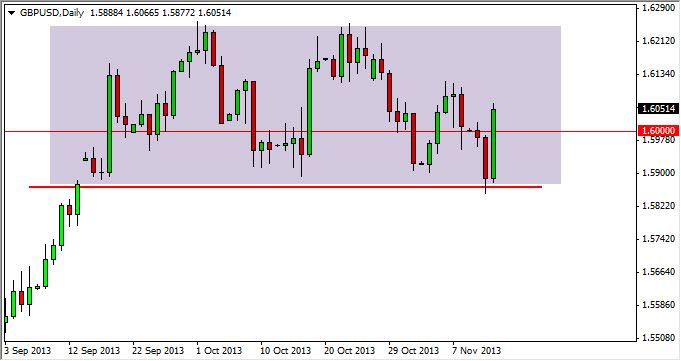

The GBP/USD pair rose during the session on Wednesday, slicing through the 1.60 handle yet again. While this number is a large significant number, it has been pierced several times so I don't feel as much trepidation in this region as I once did. I feel that the real support is down at the 1.5850 level, and that the real resistance is at the 1.6250 level. Because of this, I feel that this market goes higher based upon the large candle that we saw for the session on Wednesday.

There are several different entry points that I could use, but I prefer to use short-term charts in a situation like this, suspecting that the 1.60 level will offer a bit of support now. I will drop down to the one hour chart, possibly even the 15 min. chart until I am serious enough about buying.

Consolidation, and then possible continuation.

The consolidation that we've seen since the early part of September could simply be the market catching its breath after a fairly parabolic move over the several months beforehand. Nonetheless though, we have to keep an eye on the Federal Reserve, as if they tighten or at least cut back on quantitative easing, this market could very well fall backwards yet again.

There is a gap down near the 1.5850 level however, and this could continue to supply plenty of support. This candle from the Wednesday session is very strong looking, so I do feel fairly good about going long at this point. Besides, it simply continues the pattern that we've seen for a couple of months now.

If we did get a close below the 1.5850 level however, that would be enough to make the change my mind and perhaps look for a move back down to the 1.55 handle. That would be a difficult trade today, but the technical areas would lie at that point time, as it would be a bit of an air pocket down to the 1.55 handle. As far as going to the upside, if we can get above the 1.6250 handle on a daily close, I see no reason why this market will head to the 1.65 level.