The XAU/USD pair fell to its lowest level in seven days as demand for the American dollar increased after the weekly unemployment claims and Chicago PMI figures beat forecasts. The Chicago purchasing managers index came out stronger than expected with a print of 65.9 and a report released by the Department of Labor showed that the number of Americans who filed for unemployment insurance payment for the first time decreased by 10000 to 340000.

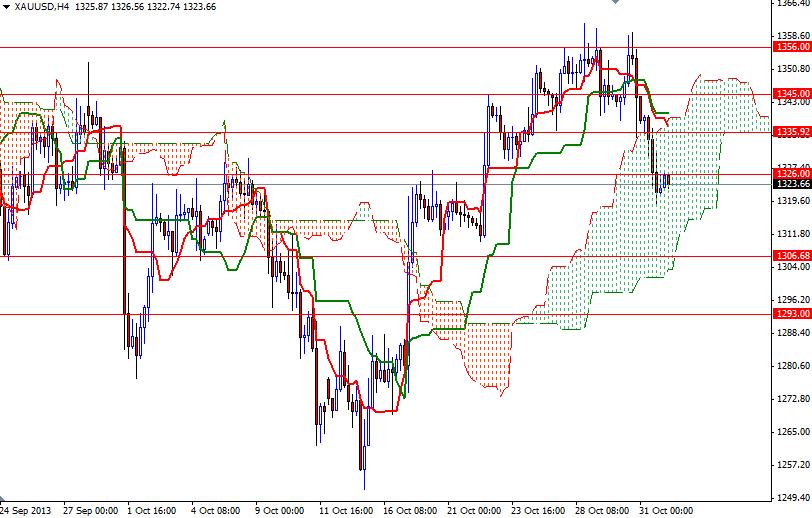

Although we fell below the 1326 level, the shiny metal recovered some of earlier losses on encouraging manufacturing data from China. Currently, the XAU/USD pair is moving inside the Ichimoku cloud on the 4-hour chart and this suggests that prices might be trapped between the 1335.92 and 1306.68 levels in the near term. If prices resume the bearish tone of the last few days and break yesterday's low which also happens to be Fibonacci 38.2, possibility of 1306.68 printing on the chart will increase.

A daily close below this support would probably take us back to the 1293 - 1298 area. If the bulls gain some strength and push the pair above the 1326 level, we may see a bullish attempt towards 1335.92. Beyond that level expect to see resistance at 1345/8 and 1356. The bulls will have to break through this strong barrier in order to test the 1366 resistance level.