The XAU/USD pair printed another bearish candle at the end of the week on the back of the solid U.S. economic figures. Data released from the Labor Department report showed that unemployment rate rose to 7.3% but non-farm payrolls grew 204K in October, well above expectations of 120K. Federal Reserve Bank of Atlanta President Dennis Lockhart said “It is an encouraging number. If we find the employment data to be convincing, that job growth is going to be sustained, that will certainly advance the time in which it would be appropriate to possibly pull back on asset purchases”.

The market is back to focusing on economic data out of the world's biggest economy and because of that the American dollar is heavily influenced by strong numbers. Although recent optimistic data fanned expectations that the Federal Reserve may back down from asset buying sooner than thought, I think it is a little too soon to expect a major perspective change. First of all, the central bank wants to see substantial improvement in the labor markets, not just a couple of good numbers. Second, I don’t think they would want to rock the boat before January when negotiations to raise the U.S. debt ceiling and reduce the overwhelming debt will begin. However, this does not change my long term view (unless the U.S. defaults) because the candle pattern suggests that investors’ confidence in gold has been diminishing since the sell-off we witnessed back in April and the Fed will start reducing its bond-buying stimulus eventually (either the cost of purchases will outweigh the benefits or the unemployment rate will reach the Fed's threshold). I still expect gold prices to remain in a massive consolidation zone between 1488 and 1150 for several weeks.

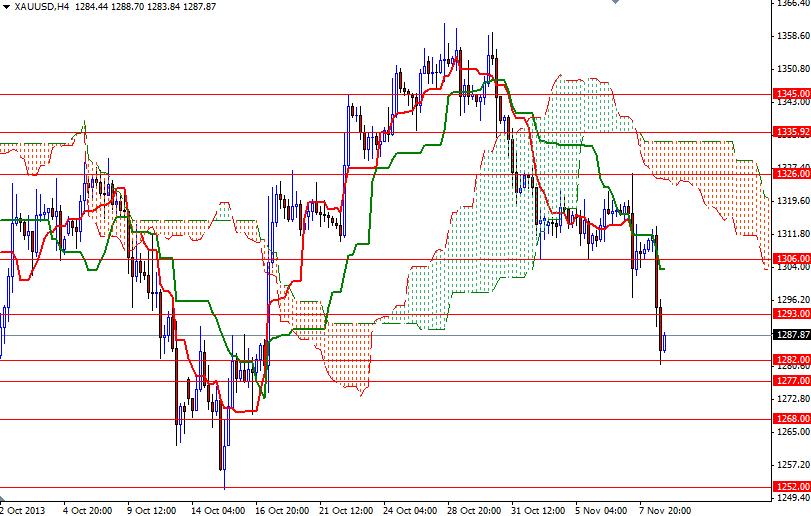

From an intra-day perspective, the key levels to pay attention will be 1293 and 1277. If gold prices break below 1277, the market will probably test the 1268 and 1252 supports next. Since prices do not fall in straight lines, we should also consider a bounce if the bulls buyers decide to step in around the 1277 level. A break above the 1293 level might give the bulls extra power they need to revisit the 1303 - 1306 area. In order to ease selling pressure, the bulls will need to push prices above 1326.