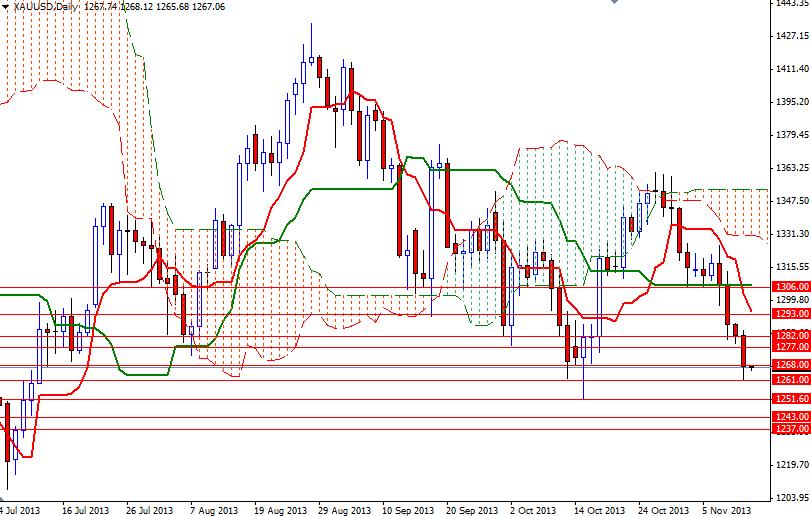

Gold prices continued to decline yesterday and hit the lowest level in four weeks. After falling 4 sessions in a row, it appears that the XAU/USD pair found some support at the 1261 level during today's Asian session. This level has produced a bit of a bounce so far and if the bulls can carry prices above the 1268 level again, we might see a positive candle today. I don’t expect the long-term technical outlook for gold to change but some investors may decide to book their profits ahead of Janet Yellen’s testimony to the U.S. Senate Banking Committee on Thursday.

Since upbeat U.S. non-farm payrolls data put a Fed tapering on the table for consideration at the December FOMC policy meeting, her comments on the latest developments in the U.S. economy may provide more information about the central bank's exit strategy.

From a technical perspective, the bulls will be having hard time to gain strong traction while prices are below Ichimoku clouds on the daily chart. To the upside there are bunch of critical resistance levels such as 1293 and 1306 but of course the bulls will have to clear the 1277 and 1282/5 levels before that. However, if the bears increase the downward pressure and pull the pair below yesterday's low, I think the next stop will be the October 15 low of 1251.60. If gold prices drop below the 1251.60 level, there is little to slow down the bears' progression until 1237.