The XAU/USD pair closed yesterday's session higher than opening as the American dollar lost ground after the U.S. trade balance and weekly unemployment claims data missed expectations. According to the Commerce Department, the trade deficit in the U.S. climbed to $41.8 billion from a revised $38.7 billion in August. Separately, the Labor Department reported that the number of Americans filing first-time claims for unemployment insurance payments decreased by 2K to 339K, economists had called for a drop to 330K.

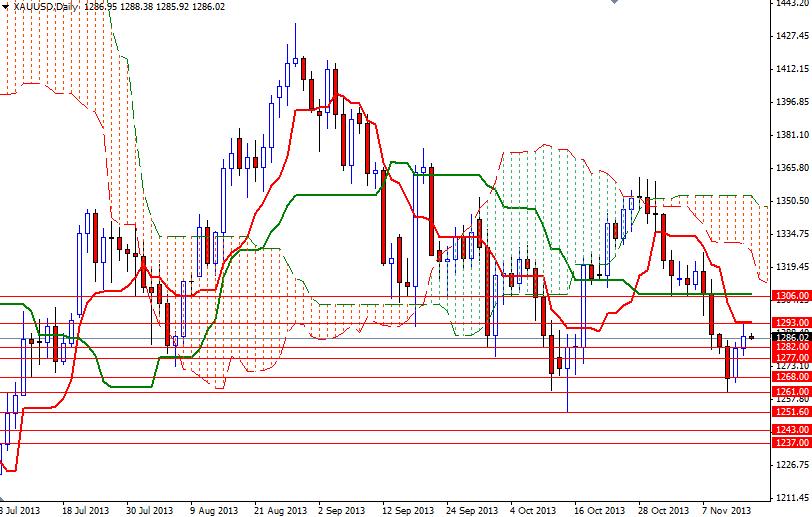

Comments from Federal Reserve Chair nominee Janet Yellen also helped providing a lift to gold. She simply repeated that the U.S. economy still needs the support of an accommodative monetary policy. Looking at the recent price action from a purely technical point of view, I think that there is still more room to the upside in the near-term. If the bulls gain more traction and successfully push prices above 1288, we might see another attempt to test the 1293 resistance level.

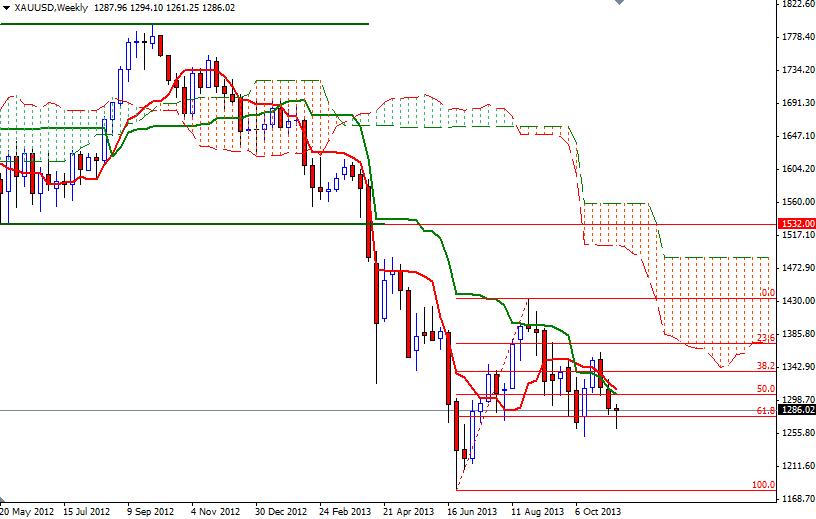

Climbing above this resistance level would make think that the pair may extend its gain and tackle the 1303/6 barrier. Since the Kijun-sen line (twenty six-day moving average, green line) on the daily chart and the 50% retracement level (based on the bullish run from 1180.21 to 1433.70) converge at the 1306 level, this might be a tough challenge for the bulls. However, if the bears increase selling pressure and defend the 1293 level, we will probably revisit the 1282 and 1277 supports. A close below the 1268 support level could accelerate downward movement.