The XAU/USD pair closed yesterday's session lower after three consecutive days of gains. Gold prices turned south after the bears increased selling pressure to defend the 1293 level. It is not only the Federal Open Market Committee meeting minutes that is coming up tomorrow, we also have U.S. retails sales and housing data. If these numbers beat forecasts, the market is going to start pricing in a faster tapering cycle again. It appears that Janet Yellen’s confirmation to head the U.S. Federal Reserve is already priced into the market as well.

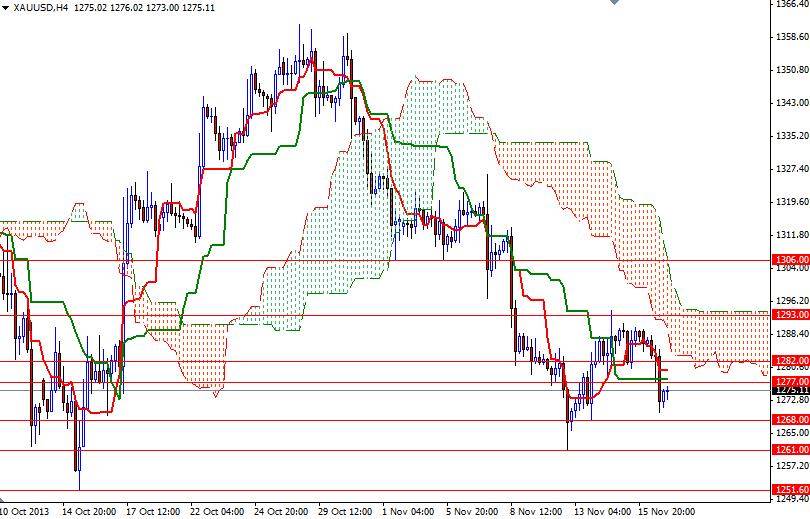

Looking at the charts from a purely technical point of view, I can't find a reason to buy gold at the moment. The weekly, daily and 4-hour charts are still bearish as prices remain below the Ichimoku cloud. The Tenkan-sen line (nine-period moving average, red line) is moving below the Kijun-sen line (twenty six-day moving average, green line) on the daily time frame. If the bears continue to dominate the pair and drag prices below the 1268/6 level, I think the 1261 support will be the next stop.

Breaking below this level increases the possibility of another attempt to revisit the October 15 low of 1251.60. However, if the bulls take over and push the pair above the 1282 level, we may see prices climbing towards the 1293 level, which happens to be the top of the Ichimoku cloud on the 4-hour chart. The bulls have to break and hold above the 1293 level in order to gain enough strength to challenge the bears in the 1303 - 1306 zone. Only a weekly close above this barrier could shift things to the bulls in the near term.