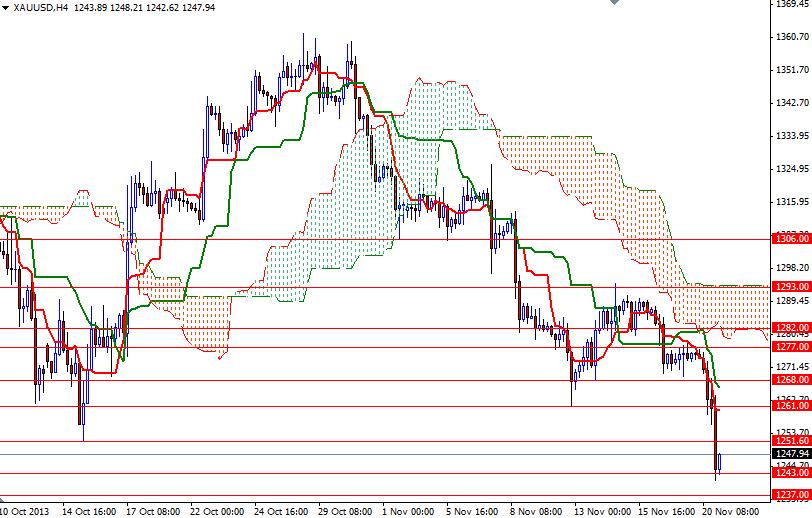

The XAU/USD pair (Gold vs. the American dollar) broke below the 1268 support level printed another bearish candle yesterday. The pair accelerated its descent and traded as low as 1242.76 after the minutes from the U.S. Federal Reserve's October meeting showed that policy makers want to exit from asset purchases as soon as they can, but are in no rush to raise interest rates. According to minutes, “They generally expected that the data would prove consistent with the Committee's outlook for ongoing improvement in labor market conditions and would thus warrant trimming the pace of purchases in coming months. However, participants also considered scenarios under which it might, at some stage, be appropriate to begin to wind down the program before an unambiguous further improvement in the outlook was apparent”.

Although the records were similar to previous statements, this made me think that if they are going to taper, they have to taper not just because the economy is improving, but because they are concerned about the cost of the program. Market players believe the Fed seems to be much closer to reducing the pace of its purchases to maintain appropriate policy accommodation and that is easing speculative demand for the precious metal.

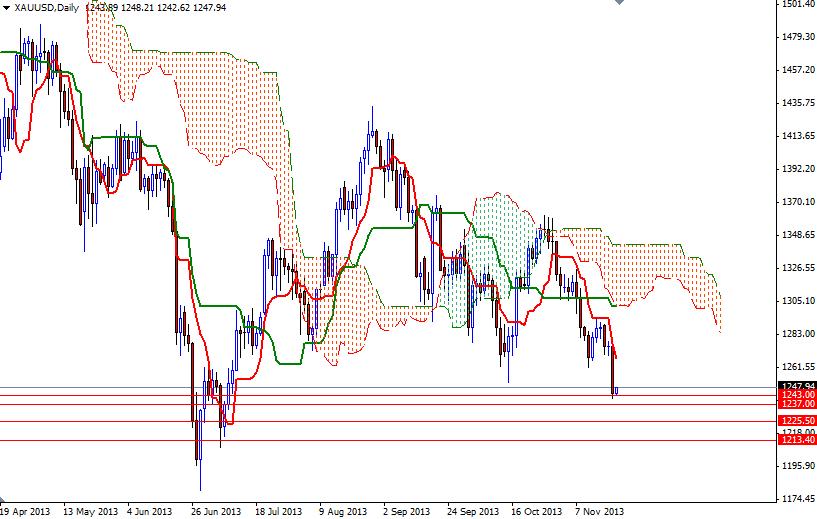

Recently, I have been repeating that I don’t expect the long-term technical outlook for gold to change and have no intention of buying gold until I see a strong bottom formation (or prices approach the average cost of production). The pair is currently trading at 1247.94, the lowest level since July 10. Today the key levels to watch will be 1243 and 1251.60.

The 1243 support level has produced a bit of a bounce so far and if prices climb above the 1251.60 today, it would be technically possible to retest the 1261/8 zone. However, if we break below yesterday's low, I think the 1237 level will be the next target. A daily close below this level could give the bulls the extra power they need to test 1225.50.