Gold prices continued to slide yesterday and fell to the lowest since July 9 as the conditions in the marketplace have dulled the precious metal’s safe-haven appeal. The XAU/USD pair has seen quite a selloff lately and so far there is no sign of exhaustion. It appears that market participants are fixated on the Federal Reserve's future plans and as a result expectations that the central bank will taper eventually are weighing on gold prices.

In the meantime, the major stock markets are gaining strength and the USD/JPY pair is holding above the 100.00 level. In the latest economic data, the Labor Department's initial unemployment claims numbers came out at 323000, down from the previous week's 344000 and below expectations of 333000. Chinese November flash HSBC manufacturing PMI data were weaker than expected.

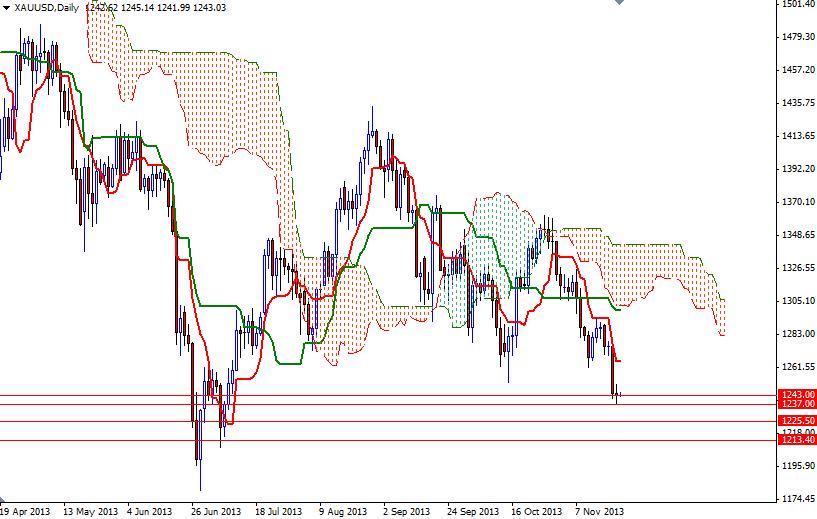

Looking at the charts from a purely technical point of view, the odds favor further drop if the XAU/USD pair remains below the 1268 level. However, prices do not rise or fall in straight lines and the 1237 support level is a place which can cause a rebound so chasing gold lower (before breaking below 1237) could be a bit risky. If the bulls can push and hold prices above the 1243 level, they might have a chance to test the 1251.60 resistance level.

Only a close above that level would open the doors to the 1261/8 area. As mentioned earlier, I think the key to the bearish continuation will be the 1237 level. If the bears continue to push downward and 1237 gives way, support can be found at 1225.50 and 1213.40.