The XAUUSD pair closed the day lower than opening as the American dollar gained some strength after a report from the Commerce Department showed the U.S. economy grew at a 2.8% annual rate in the third quarter and data released by the U.S. Labor Department revealed initial jobless claims dropped by 9K to 336K. Although yesterday's data provided further evidence that the U.S. economy is not in a bad shape, I doubt that Fed officials are too happy with these numbers. Of course, the surprise ECB rate cut was another element contributing to a stronger dollar.

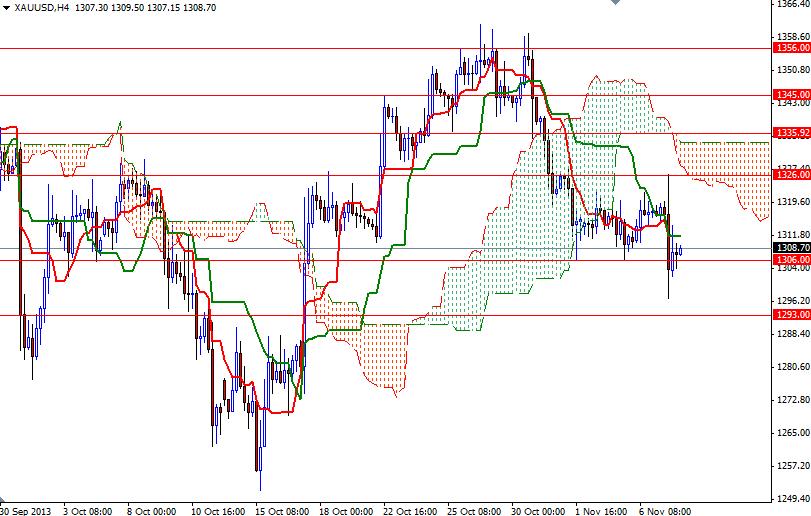

Today's major event will be the release of non-farm payrolls data. This report will give market players some insight into how long the Fed will maintain its massive stimulus. Yesterday's candle shows that there is an intense battle going on between the bears and bulls. The pair encountered heavy resistance at the 1326 level but the daily close was still above the 1306 level. As I mentioned in my previous analysis, the Ichimoku clouds above the current prices represent resistance zones and because of that the bulls are having hard time to gain traction.

I think U.S. employment data will be the catalyst we need to break out of this consolidation. If the bulls can push the pair above the 1326 level, we could see a bullish run targeting the 1335.92 and 1345 levels while a close below 1306 would suggest that the bulls will have to wait a little longer. Breaking below the 1293 support could increase speculative selling pressure. If that is the case, I will look for 1282 and 1277.