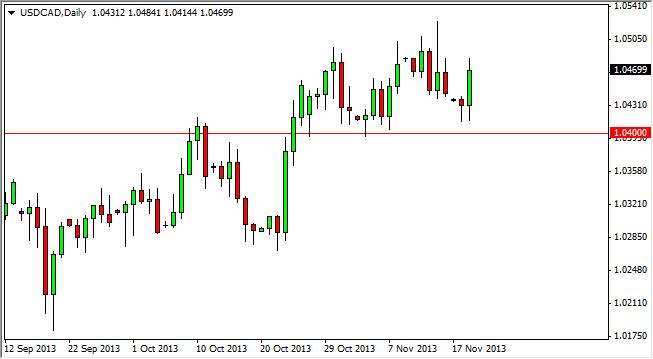

The USD/CAD pair initially fell during the Tuesday session, but found enough support above the 1.04 handle in order to bounce and form a fairly supportive and positive looking candle. The market found a little bit of trouble just below the 1.05 handle, which of course is the top of the recent consolidation area that this market has been stuck in for the last couple of weeks. This makes sense, simply because both economies are so interconnected, and as a result this market tends to be very sideways most of the time, and then make an impulsive move in one direction or the other.

This market looks primed to go higher, but we have a shooting star from last week that suggests that there is a significant amount of resistance that the buyers will have to overcome. However, I do believe that longer-term we will go above the 1.05 level, aim for the 1.06 handle, and if we can get above there we will go to the 1.10 handle as there is a bit of an "air pocket" above the 1.06 level.

Pay attention to the oil markets

The WTI Crude Oil markets look very weak and vulnerable at this moment time, and this of course works against the value the Canadian dollar. As the Canadians are so tied to oil for exports, it is going to be difficult for the Loonie to continue to appreciate, so therefore this market should go much higher over the longer term. This will be especially true if the WTI market falls below the $93.00 level, and even more so if we managed to fall below the $90.00 level.

As for selling is concerned, I have no interest in doing so until we get well below the 1.0250 level, which is something you isn't going to happen anytime soon. The 1.04 level should be massively supportive anyway, so a pullback to that level should offer plenty of opportunity for buyers to step back into the market and push this pair higher, as momentum may need to be picked up in order to do so.