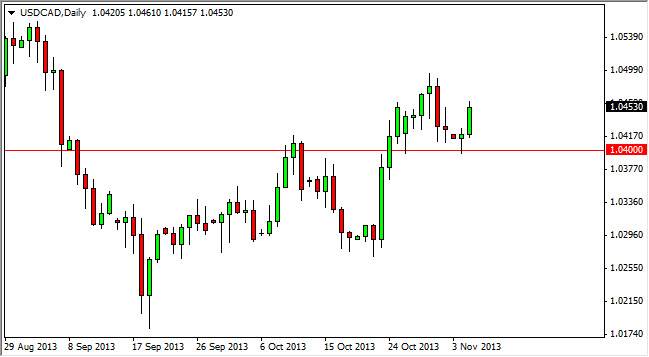

The USD/CAD pair rose during the session on Tuesday, breaking the top of the hammer that had formed on Monday. I had stated that the hammer formed at the 1.04 handle, and as a result this market looks very well supported at the area, based not only upon that candle, but the previous resistance. A break of the top that handle of course was a buy signal, but the 1.05 handle should be the top of the consolidation area, and in the being fairly resistive.

Ultimately, I believe this pair continues to go higher, not necessarily based upon demand for the US dollar, simply based upon the fact that the Canadian dollar will continue to struggle. This is because the market is a bit different than other ones in the sense that the Canadian send 85% of their exports into the United States. With the weak employment numbers coming out of United States, demand for Canadian exports will simply dry up. If that's the case, then you can expect to see US dollar continue to appreciate against the Canadian dollar, although it is somewhat counterintuitive.

Watch the oil markets, they appear to be breaking down.

The oil markets have been falling rather hard over the last couple of weeks, and as a result the Canadian dollar has been punished. This correlation should continue to hold fairly true, and as a result I expect this pair to continue higher. 1.05 will continue to be resistance, but I think there is a high likelihood that the market breaks above there, and then finally breaks above the 1.06 handle. And it does that, I fully expect see this market go as high as 1.10 over the course of the next several weeks.

Keep in mind, this pair tends to go sideways for a great. Time, and then suddenly shoot straight up or straight down. I think we may be getting paid you see one of these situations, but more than likely have to wait until Friday to see any true fireworks as that employment number will be vital.