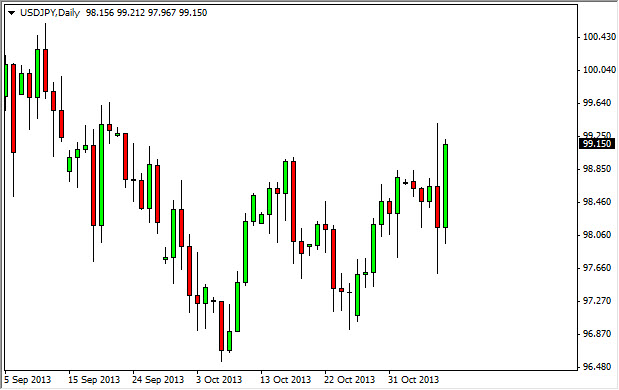

The USD/JPY pair rose during the session on Friday, in response to the nonfarm payroll numbers coming out stronger than anticipated. This puts this market in the spotlight again, simply because the interest rate differential should be favoring the Americans for the time being. After all, the Federal Reserve could be a bit closer to tapering off of quantitative easing now, which means less bond buying. If you think about it, it makes sense that the interest rates coming out of US treasuries are almost nothing, as the Federal Reserve continues to buy government bonds, thereby artificially increasing demand. If they find themselves in the state of tapering off, this will automatically push the year olds coming out of US treasuries higher. That is what will drive money from left to right across the Pacific Ocean.

Don't forget the Bank of Japan

Don't forget about the Bank of Japan, and its mission to drive down the value of the Yen. After all, the Bank of Japan has just begun to buy massive amounts of bonds, and that of course does just the Federal Reserve is been going, driving down yields and therefore making investing in Japan less attractive. This drives the value of the Yen, simply because there is less demand for the local currency.

All that being said, the fact that we close above the 99 handle on Friday is a bit of a victory. If you can see this market go higher, 100 will be the next target, and if we can get above there I feel that this market will continue to go much, much higher. The 105 level is more than likely going to be the next target as well, as it is a nice large round psychologically significant number.

There will be times when this market pulls back, but as you can see we continue to bounce every time it falls, and because of that I think that short-term traders will continue to do well also, but if you are a long-term trader in very patient, we could begin to see the beginning of an uptrend again.