Our previous analysis last Monday ended with the following predictions and recommendations, as applicable to the price action that has occurred since then:

1. Short touch trade off the upper triangle trend line.

2. Long touch trade from the beginning of tonight’s Tokyo session at any first retest of the broken inner upper triangle trend line.

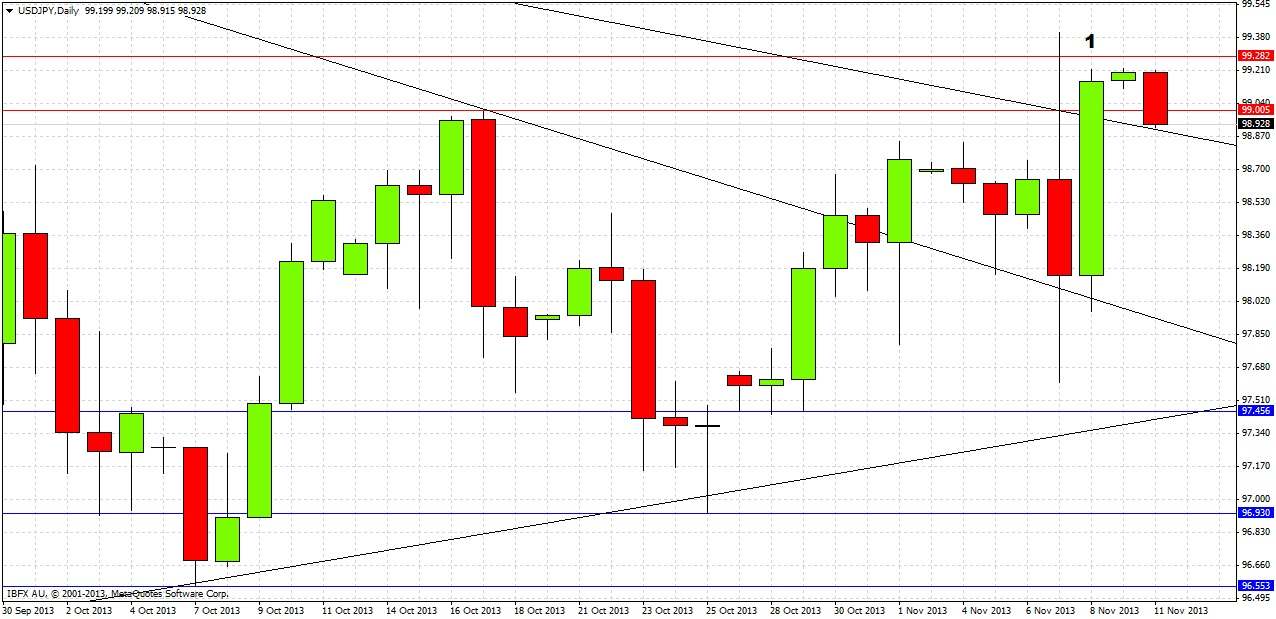

This was an excellent forecast, correctly calling both of the two best trades available with this pair last week. Firstly, the long touch trade on the retest of the broken inner upper triangle trend line recommended in 2. was triggered around the start of the London session on 5th November. The touch trade had a maximum drawdown of only 3.5 pips, and ran to a maximum profit of approximately 120 pips on 7th November. Traders unwilling to take a touch trade could have entered following the highlighted bullish reversal bar rejecting the trend line retest, marked at (1) in the 1 hour chart below.

Secondly, the short touch trade recommended off the upper triangle trend line was triggered on 7th November, as the ECB rate cut surprised the market and the pair shot up to a high of 99.40, breaching the trend line by 43 pips, then falling to a maximum gain of approximately 135 pips within 5 hours. One of the primary difficulties with touch trading trend lines is deciding where to put the stop loss. In this case, a stop loss less than 43 pips would have led to a loss. After major market news it can often be a good idea to widen stops and lower risk.

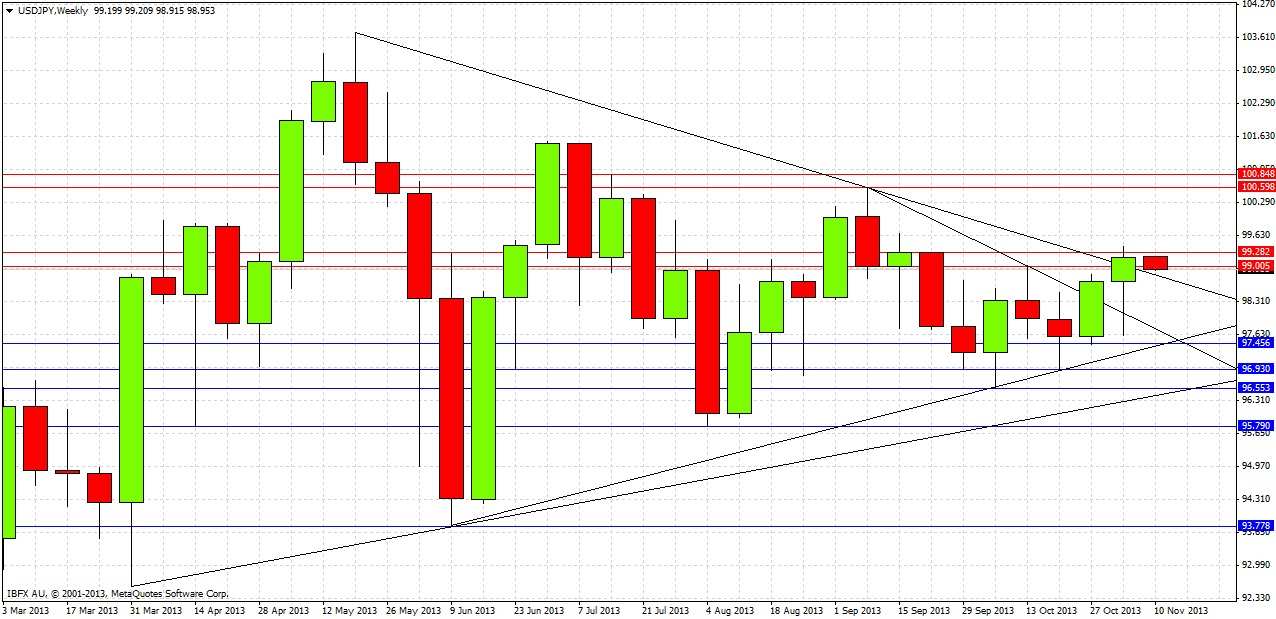

Let's start looking to predict what might happen over the coming days by taking a look at the weekly chart now:

Last week produced a bullish candle that broke the upper triangle trend line and closed just a fraction above it. The candle closed near the top of its range and produced a long lower wick. The previous week’s low held and a bearish trend line was rejected. These are all bullish signs. However the upper trend line has not been decisively broken and there is now some ambiguity with the upper trend line so there is some doubt remaining here.

Let’s take a look at the daily chart to try to find some more pointers for the future:

The action on the daily chart has been all over the place during the past few days. The most noticeable candle is last Friday’s candle marked at (1), which is a bullish reversal candle that closed very close to its high and closed above the upper triangle trend line.

We can see also that at the time of writing, the price has retraced to the broken upper trend line, but so far has not broken below it. This can be seen more clearly on a shorter term chart such as the 1 hour chart. This is a bullish sign if this trend line holds, but notice how we have failed to clear the top of the resistance zone at 99.28.

Another development of note is the support zone that has been firmly established at around 97.50 below.

It is possible to draw a new upper triangle trend line connecting last week’s high. However, the upper trend line is starting to look ambiguous, so it seems preferable to look for a sustained break above 99.28 to determine a bullish breakout.

It is hard to make any confident recommendations yet as the price action needs to play out a little first. However there are a few things to watch out for:

1. If the broken higher upper triangle trend line is breached to the down side, this is a mildly bearish sign.

2. There is pretty good support around the 97.50 level. If this is retested and especially if at a time when the level is confluent with one of the trend lines, there should be a long bounce.

3. If there is a successful breakout past 99.28 that holds for a few hours at least, that will be a bullish sign. The target then would be the 100.00 to 100.40 zone.

4. The lower upper triangle trend line may also act as support.

5. If an overall bias has to be chosen, it should be bullish, but we are taking no bias.