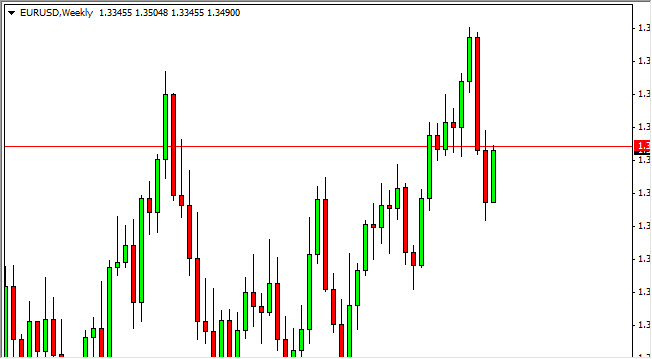

EUR/USD

The EUR/USD pair rose over the course of the week, slamming into the 1.35 handle at the close. However, we are still experiencing resistance in this area, and as a result I am hard pressed to buy at this point. I also think that we could see the market offer resistance all the way to the 1.36 level, so I am willing to sell resistive candles all the way up to there. I think consolidation between the 1.36 level on the top and the 1.33 level on the bottom is likely.

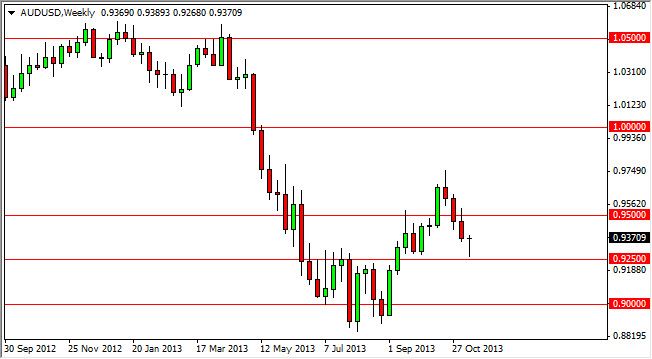

AUD/USD

The AUD/USD pair fell down to the 0.9250 level, and then bounced all the way back to form a hammer for the week. This looks strong to me, and as a result I expect the Aussie to do well in the interim. This market is going to have a bit of resistance at the 0.95 level, but I think ultimately it goes as high as 0.9750 during this move. The selling of this pair is going to be almost impossible as there is so much noise all the way down to the 0.90 level.

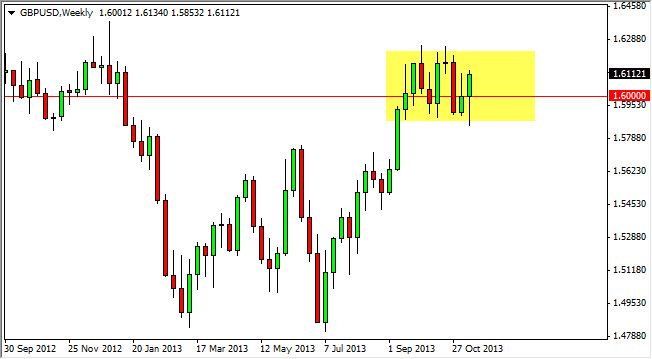

GBP/USD

The GBP/USD pair initially looked weak over the course of the past five sessions, but you can see that the market bounced enough to form a hammer-like candle, suggesting that we are going to go higher. However, I see that we are still on consolidation, and therefore would need to see a break above the 1.63 level in order to get overly bullish. If we do get that, I would expect the market to make a trip to the 1.65 level next, as it is the next large round number.

As far as selling is concerned, I would have to see the 1.5850 level broken to the downside in order to do so, and at that point in time I would expect to see the 1.55 level tested again. However, I believe this market is going higher ultimately.

USD/JPY

The USD/JPY pair broke out to the upside this past week, breaking the top of the hammer that had formed the previous week. This of course is a bullish sign, and because of this I am bullish of this pair. Also, the markets seem to be anticipating the possible tapering of quantitative easing, which would drive the value of the Dollar higher over time, especially against the Yen which has a very dovish central bank behind it. This being the case, I am long of this pair.