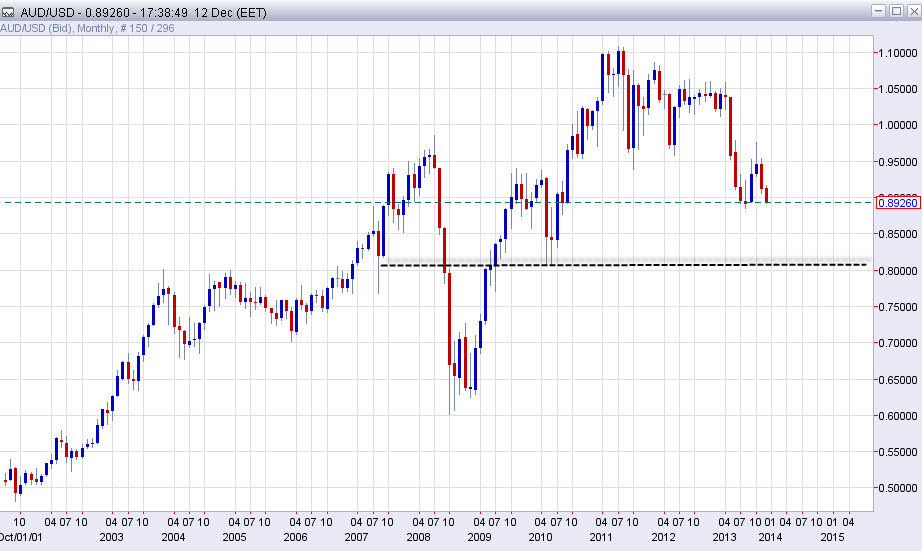

The AUD/USD pair has seen the second half of 2013 as brutal. The market has fallen from 1.05 to the sub-0.90 level, and as a result should continue to see weakness in the first half of 2014. The market should fall as far as 0.80 over the course of several months, and at that point in time there will be major decisions to be made about the Aussie.

In the end, the 0.80 level looks very, very strong as support, so I think that is about as low as we can get from a technical standpoint. After all, this would be a round trip from 2007, and this would of course be a significant move in general. Having said that, this pair will certainly chop around between here and there, and with that I think this will be a volatile market during the first several months of 2014 without a doubt. It will have a downward bias though, so I will only be selling on bounces that show significant resistance.

0.85 will matter as well….

The 0.85 level will matter also, and you can expect some kind of significant bounce from that level when we get there. The area is just a stop on the way to the 0.80 level though, and I should be remiss if I didn’t point out how important 0.80 was during the 2003-2007 level. I cannot stress this area enough, and how much it will mean to the market. I think it will take something calamitous for this pair to spend any serious amount of time below that level. In fact, if we reach it – I am going to put on the largest position I can.

The alternate scenario could be for a bounce from the current region, but I would suspect that will only remain a selling opportunity in the end, and this would likely be treated as such by longer-term traders. This is where a lot of the large money dwells, so I think these people will keep a lid on this pair at the 0.95 level. Only a complete admission by the Federal Reserve that quantitative easing can’t happen will push this pair higher, mainly on a sympathy move with gold markets.