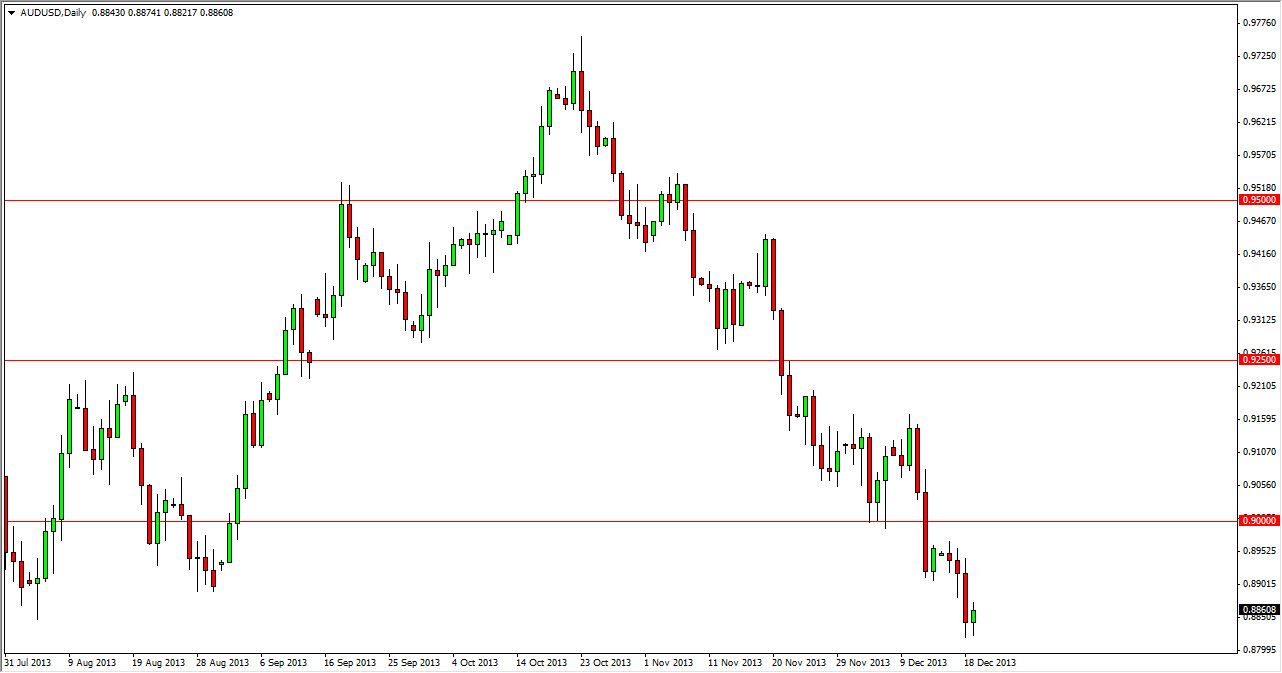

The AUD/USD pair bounce during the session on Thursday after falling significantly on Wednesday. The 0.8850 level has offered enough of a boost with the market that remains somewhat bland, I think this a short-term at best. Because of this, I am watching this for a resistant candle in order to start selling again, as the Australian dollar looks completely broken. One very obvious spot to look for this resistance at is just below the 0.90 handle, and I would not hesitate to get aggressively short of this market on some type resistant candle in that particular area.

On top of the broken look of this chart, you can also see that the gold markets are starting to fall apart as well as we closed below the crucial $1200 level, which signifies the gold markets could very easily drop to the $1000 an ounce level with a little bit of a push.

Commodities in general could be hurt

Looking at the commodity markets in general, I believe that the US dollar could punish most of them. Obviously, the gold markets will be crucial as it is one of the most commonly traded commodities out there, and that of course will continue to weigh upon the Australian dollar going forward. However, there are other commodities that you need to pay attention to when it comes to the Australian dollar, such as copper. Keep an eye on Asian economic growth as well, and whether or not the Federal Reserve could continue to taper off of quantitative easing.

The Australian economy itself is and going as well as once was, so I believe this market will end up hitting the 0.85 level given enough time. That level will cause a significant bounce in my opinion, but it is only a stop on the way down to the 0.80 level later in the year 2014. I believe that this pair continues to get beat up for a significant amount of time going forward. I would not be a buyer of the Aussie dollar until we get above the 0.9180 level.