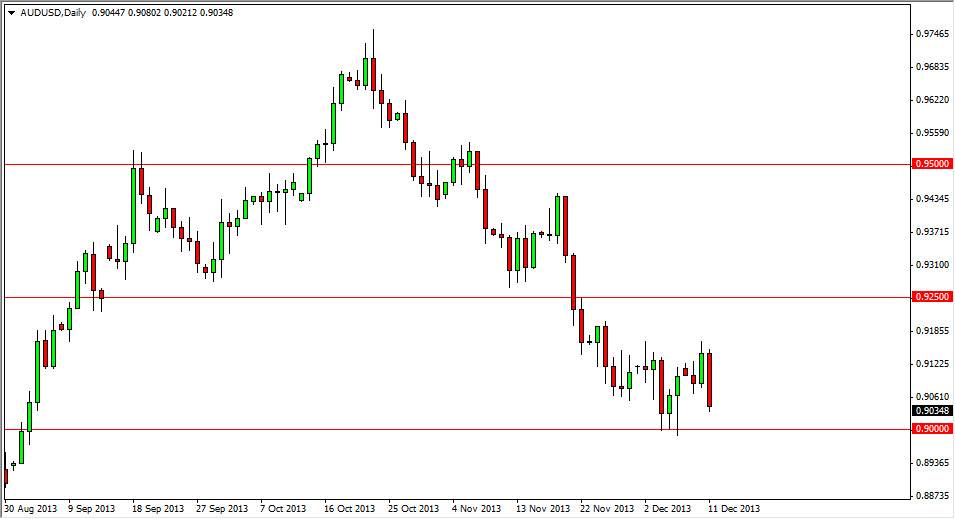

The AUD/USD pair fell during the session on Wednesday, pressing up against the 0.9050 level. While this does look very, I do not feel that you can sell this pair until we clear the 0.90 handle decisively, and that these on the daily close. If we get below there, then obviously we could go much lower as it is a large, round, psychologically significant number. I believe on a break below there were heading towards the 0.88 handle without too many issues, over the longer term.

Watch the gold markets, as they have a great influence on the Australian dollar, and it should be noted that they do look a bit soft at this point. However, while we have the 0.90 support level in this pair, we also have the $1200 level in the gold markets that should offer pretty significant support as well. I do feel that more than likely the two will coincide with a couple of days of each other. In other words, if we break down below $1200, this pair will certainly break down below the 0.90 handle, or possibly vice versa.

Possible consolidation, or accumulation?

The other scenario. Besides a breakdown in this pair is that we could simply be consolidating of the moment, and waiting to bring in the New Year before breaking down this market a lot of times you won't see the move until after January 1, simply because most traders are going to be taking their vacation. However, I think this market could also be in a possible accumulation phase. This is when the so-called "smart money" is starting to accumulate positions. While I think this is the least likely of scenarios, this would be right about where you would expect the move like that. Is because of this that you are going to have to be careful, simply because we don't have that clear-cut signal quite yet. The 0.9250 level above should be resistive, so even if we get a breakdown from here. I have a hard time believing that we can get above there before or the end of the year either. However, you always have to have all of your scenarios lined up, and I believe the most likely would be a breakdown, and I would not hesitate to sell, be it in December, or 2014.