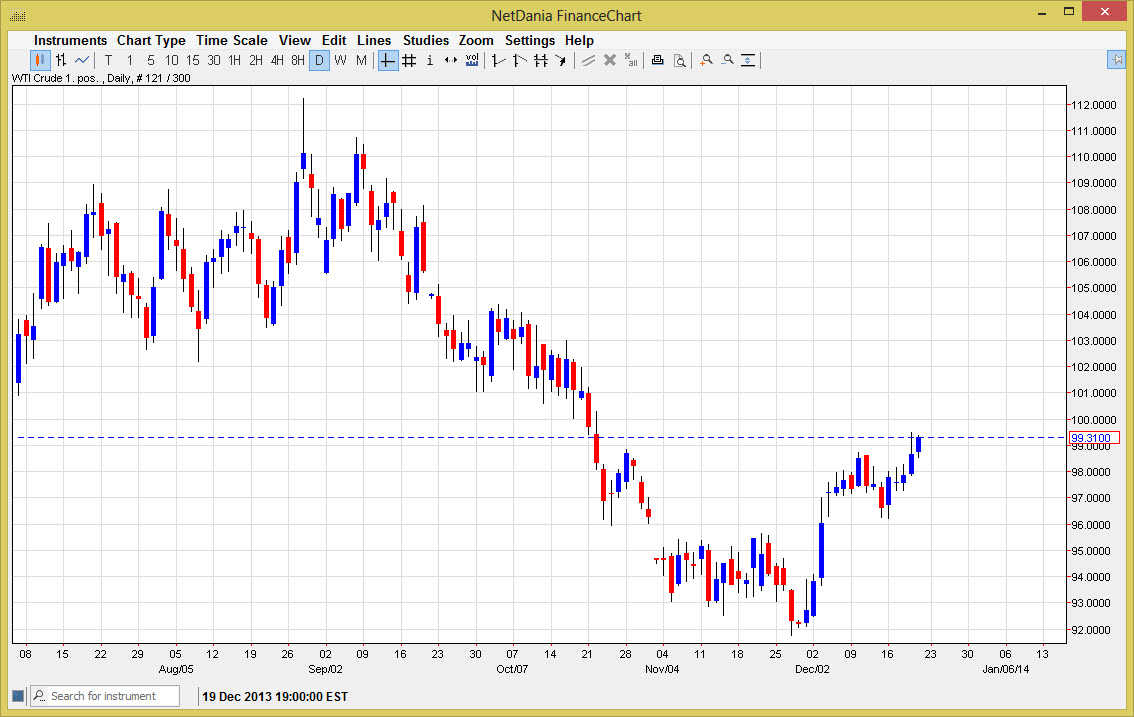

The WTI Crude Oil markets rose during the session on Friday, continuing the bullish attitude that we have seen for some time now. This market looks like it’s destined to test the $100 level, and then the $101 level. This could be a reaction to the better than anticipated economic numbers out of the United States for some time now, not the least of which would be the jobs report.

Even though the Federal Reserve has recently announced a minor pullback in the quantitative easing program, and that the US dollar has been appreciating, this market going higher doesn’t necessarily defy logic. While a lot of people looking at the inverse, the truth is that a strong US dollar could possibly exist with higher oil prices simply because there could be larger amounts of demand out of America based upon employment, and GDP numbers.

Demand trumps all.

Demand trumps all when it comes to pricing. I don’t care what they value the US dollar is, if there is demand for oil, the price goes higher. That’s just the way it is, and people need to realize that it isn’t only a matter of what the currency underlying the financial instrument is doing, although it is important.

I believe that we are going to see a very pro-US move over the next several months, and this will include increasing oil prices in markets such as the WTI grade. This will necessarily translate into some of the other sister markets, such as the Brent markets. That’s because Brent is used more by Europeans, and there are concerns about deflation on the continent. In fact, some of the more astute oil traders may start shorting Brent, while buying WTI in the near future. Playing the spread is a way some oil traders make a living, although it is well beyond the scope of my knowledge or interest.

All things being equal, I think pullbacks should continue to offer buying opportunities, but I do recognize that the $101 level will be a bit of a challenge. Above there though, this market goes to $104 as it was the top of that consolidation area.