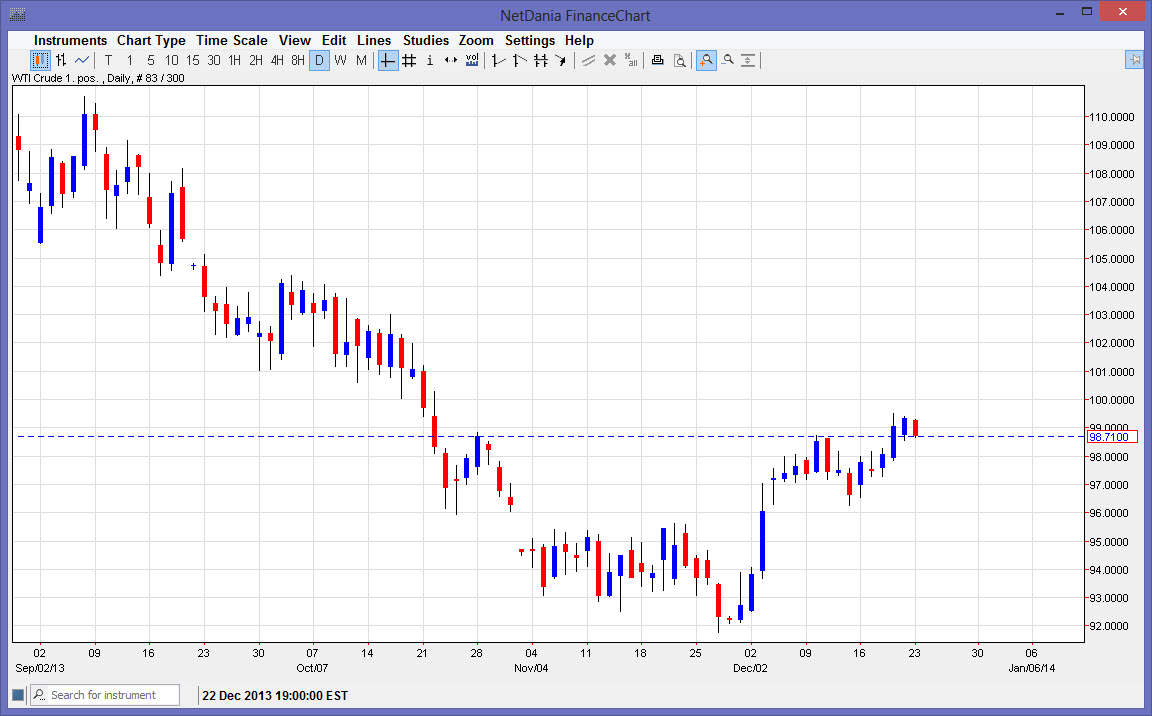

The WTI Crude Oil markets fell during the session on Monday, pulling back from the $99.50 handle. Ultimately, I see a lot of support just below current levels, and therefore I’m not willing to start selling into this move. That being the case, I think that most of the pullback has to do with the fact that we are approaching Christmas, and not any type of fundamental change in the outlook of the market.

Because of this, I’m willing to sit back and let the market fall to lower levels before buying yet again. However, expect a lot of quiet trading of the next several sessions, as most traders will simply be away from their desks, and not interested in was going on in the oil markets. Most of the larger traders will simply be gone completely, so therefore the illiquid conditions will create their own challenges.

Slowest week of the year

This is one of the slowest weeks of the year, if not the absolute slowest week of the year. However, I can look at the charts and suggest that there are a couple levels to pay attention to. After all, the $96 level still looks very supportive to me, and even if we pulled back there during the holiday seasons I would be willing to buy any type of supportive candle in that general vicinity. With that being said, you simply have to remember that support is support, no matter what time it happens.

I believe that the market is going to head to the $101 level eventually, so a supportive candle between here and the $96 level is a buy signal as far as I can tell. That move is one that I fully expect to see, but I don’t know if we can do in the next couple of sessions, simply because of the Christmas holiday closing down most of the electronic trading on Wednesday, and the fact that most of the big money won’t be around. However, if you are a little bit longer-term trader, a supportive candle is an invitation to go long of a market that should reenter the previous consolidation area, and eventually aim for the $104 level.