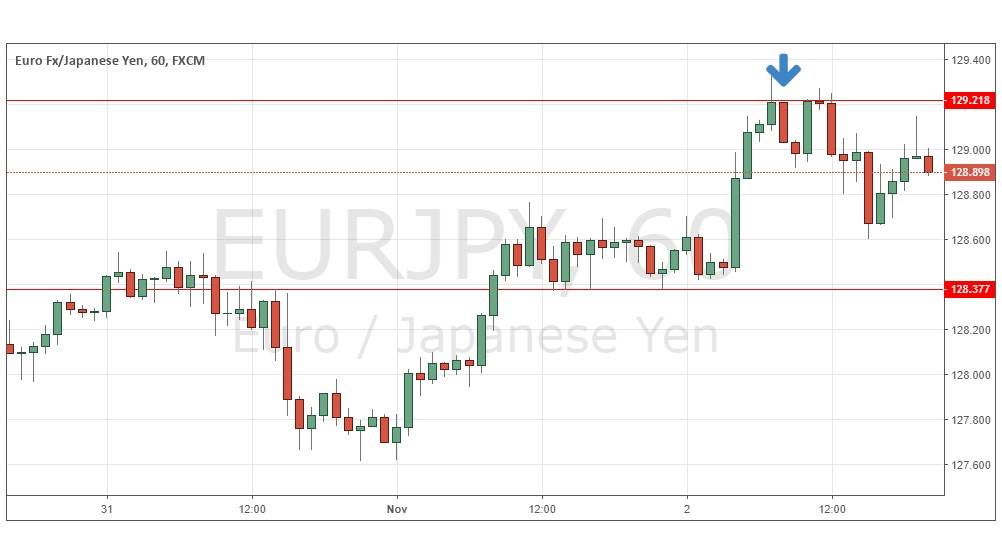

The EUR/JPY pair went back and forth on Wednesday, solidifying my opinion on this pair as being a bit stagnant at the moment. However, you have to keep in mind that this pair is very sensitive to risk appetite in general, and therefore it doesn't surprise me that this market is running into a little bit of trouble appear. When you look at the trajectory of the recent uptrend that also lends credence to the idea that the market may be a bit overextended and simply exhausted at this point.

This isn't to say that I'm looking to short this market although an extremely aggressive trader could do just that. On a break down below the lows of the session on Wednesday. I would rather simply let the market come back to me and the levels that I find interesting. 137 is without a doubt the most interesting one to be honest chart, and I do believe that we could see the market pullback rather quickly to that area. However, there's also the possibility that we simply go sideways. Either way, this market needs to relax.

Nonfarm payroll numbers, and the effect on this seemingly unrelated pair.

The nonfarm payroll numbers will drive risk appetite in general. This week. Because of this, expect this pair to be greatly influenced by what happens with that announcement, and as a result it might be a little bit quiet over the next couple of days. I believe that this market will soften up. Between now and the announcement on Friday, whether or not it can drift lower might be a different question, but I certainly don't see a going much higher. This is especially true when you look at the fact that the 140 level did keep the buyers down a bit.

Even if we pulled back significantly, I would not be surprised to see 137 be a great entry point, and I would definitely expect 135 to be an area where a lot of buyers would be waiting. Because of this, I'm not a seller under any circumstance, and simply am looking for value below.