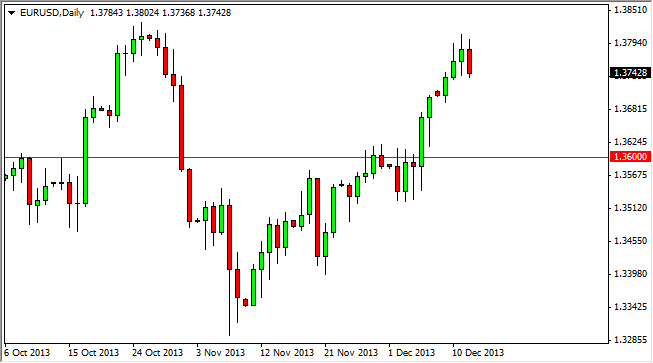

The EUR/USD pair fell during the session on Thursday, as the 1.38 level continues offer far too much in the way of resistance. This area continues to be a target for traders, and until we break out above that level, it's going be difficult to buy-and-hold this pair unless of course we pullback and find supportive actions. A supportive candle near the 1.36 level would be a massive buy signal as far as I can tell.

I even believe that there is so much support under the 1.36 level that we really can't even think about selling until we get below the 1.35 handle. I believe that once the market tries the 1.36 level there will be plenty of people willing to step in and push things higher. However, I would not surprise me at all to see the buyers stepped then even before then.

Federal Reserve.

The Federal Reserve continues to be the main driver in this pair, and whether or not it can pull back from the bond buying program. That being said, pay attention to the jobs numbers as it will be one of the main drivers of the decisions that the Federal Reserve makes. After all, the nonfarm payroll number for November was stronger than anticipated, and that of course somewhat shocked the markets. However, you can see that the market has turned back around, and now favors the Euro. This might be because the numbers out of the nonfarm payroll number were good, but not good enough for the Fed to actually taper off right away. Will we need to see is several months’ worth of jobs improvements to really be concerned about that.

On the other side of the Atlantic, the European Union is worried about deflation. Because of this, I think it's only a matter time before the Euro sells off, but it will be later in 2014, not anytime soon. The market is still trying to focus on American problems, and thereby giving the Europeans a little bit of a free pass at the moment. However, as soon as the jobs market looks good in America, the Euro will be in for a bit of a beating. In the meantime, I still think we have the 1.40 level.ù