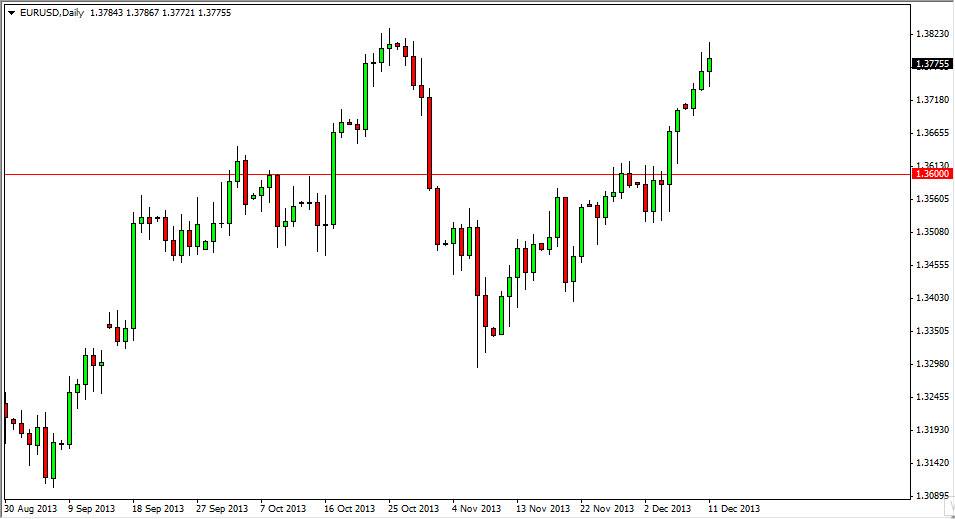

The EUR/USD pair went back and forth during the session on Wednesday, ultimately settling on a slightly positive candle. However, we did not manage to close above the 1.38 handle, so I don't have a buy signal quite yet. I suspect that the 1.38 handle will be rather resistive, based upon the fact that we turned much lower from that level in October, and as a result I need to see that daily close above there in order to feel comfortable going long for any real length of time.

A pullback is very possible, and I believe that it will simply be a buying opportunity for those who are little bit more long-term oriented. All things being equal, if we can get above the 1.38 handle, I see absolutely no reason why we won't end up going to the 1.40 level afterwards. We are at the end of the year though, so even if we get that move anytime soon, it could be interrupted by the Christmas and New Year's holidays.

Jobs numbers will continue to drive the value of the US dollar.

All things jobs related in the United States as far as economic announcements are concerned will be followed closely. The Federal Reserve still is on watch for whether or not they can taper off of the bond buyback purchase program, and as a result quantitative easing itself. There is no "on or off" switch to speak, but we do know that the Federal Reserve board members have stated that they are concerned about the employment situation in America. Because of this, that seems to be the last serious hurdle to tapering going forward, but the appointment of Janet Yellen does suggest that perhaps we will see continued weakening of monetary policy as long as possibly needed.

Ironically, the European Union is set to continue to weaken its monetary policy as well, but it seems that the market is more worried about the Federal Reserve at the moment than anything else. We have seen this before, is simply a matter of what the market is paying attention to at the moment: problems in Europe, or problems in America?