EUR/USD Signal Update

Yesterday’s signals were not triggered and expired.

Today’s EUR/USD Signal

Risk 0.50%

Entries should be made only between 8am and 5pm London time today.

Long Trade 1

Enter after a next bar long break of a confirming pin bar, engulfing bar or strong outside bar as follows:

Enter long after confirmation bar touching support level at 1.3490, ideally confluent with lower channel trend line and 50% Fibonacci retracement level nearby. If the lower wick of the confirmation bar touches the S2 pivot at 1.3486, this would be excellent. If most of a bearish bar closes below 1.3500 on the hourly chart, do not take the trade.

Stop loss at the lower of local swing low or 1.3465.

Move stop loss to break even at 1.3538.

Long Trade 2

Enter long with a limit order at a touch of 1.3405.

Stop loss at the lower of local swing low or 1.3368, initially at 1.3368.

Move stop loss to break even and take profit on half of the position at 1.3475.

EUR/USD Analysis

The pair may move strongly today as there are important USD data releases at 1:15, 1:30 and 3pm London time.

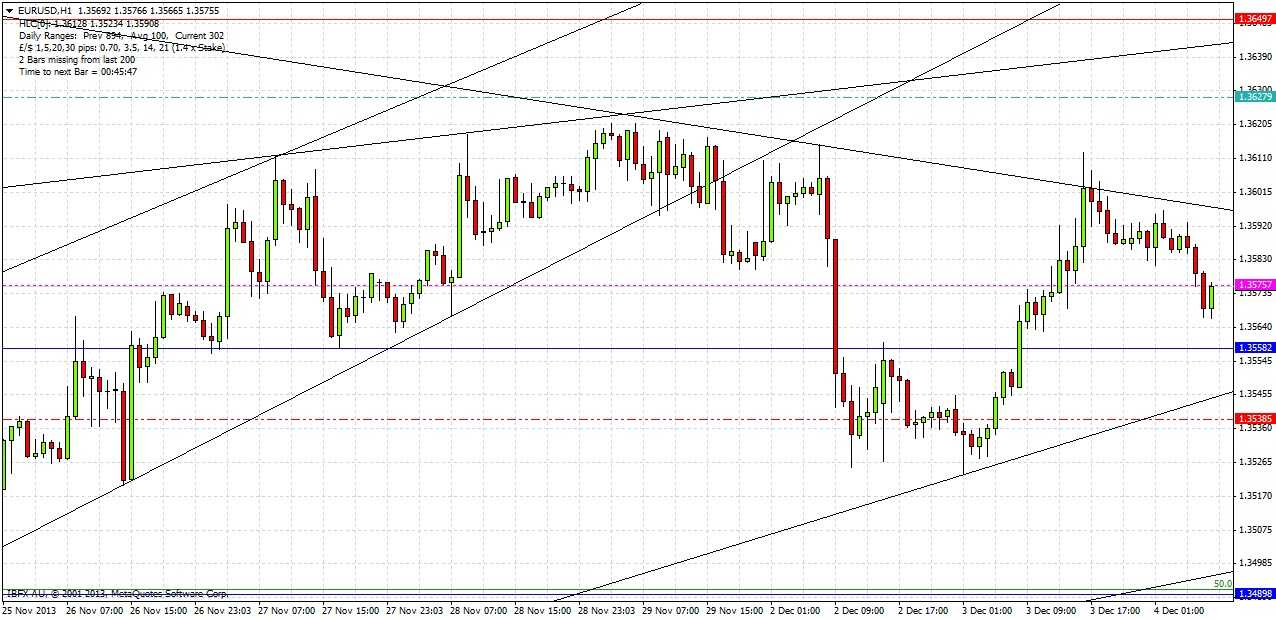

We were correct yesterday on the daily direction. As can be seen in the chart above, the price rose to 1.3600 from which it has since fallen.

We have two new trend lines: an upper bearish descending trend line which held yesterday at around 1.3600, and a lower bullish ascending trend line that is now just above 1.3540. We should not be very confident in these trend lines yet, especially the higher one, but if either or both hold firm until tomorrow 8am London time they will become more important. The overall picture with this pair is fairly complicated and this is why today’s signals are set conservatively, far away from the current action, and in line with the wide bullish channel. The 1.3558 level may have switched round yet again from resistance to support.

There is resistance overhead at 1.3650.

A close up of the chart is shown below: