EUR/USD Signal Update

Yesterday’s signal was not triggered and expired.

Today’s EUR/USD Signal

Risk 0.50%

Entry should be made only between Noon and 5pm London time today. If the price touches 1.3655 before Noon, the trade is invalidated and should not be taken.

If 1.3655 is touched between Noon and 1:30pm London time today, enter long with a limit order at 1.3655 and a stop loss at 1.3612.

Otherwise, enter long at the next bar break of an hourly pin or strong engulfing or outside bar rejecting and closing above the support level of 1.3655. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips below this level, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing low or 1.3612, depending upon how close the entry is to 1.3655. If the entry is very close, then the lower of the two should definitely be used.

Take profit on 75% of the position at 1.3690 and tighten the stop by using a trailing stop of 50 pips. Let the rest of the position ride and take half of the remainder as profit at 1.3745.

EUR/USD Analysis

The president of the European Central Bank is speaking at Noon London time today; therefore it is quite possible there could be significant price movement around that time.

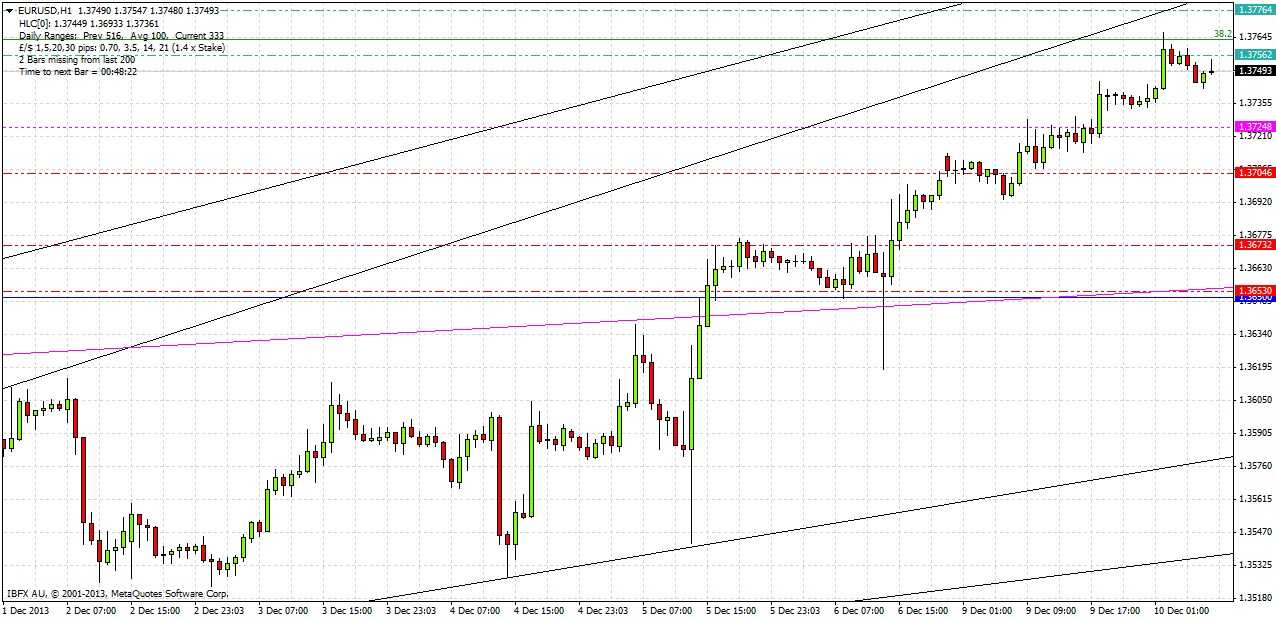

The uptrend continued yesterday, we are now not far off the 2-year high of 1.3830 that was made in October. The area around this high was very distributive and preceded a sharp fall, so it is logical to be nervous about the uptrend as we reach this level again. We also have the 38% Fibonacci retracement level of the 2011-12 large downwards move at 1.3764 that was hit this morning, acting as resistance so far. It is also quite confluent with the psychologically significant 1.3750 level. However I agree with Christopher Lewis’ bullish bias up to 1.4000 as the technical evidence is supporting it so far.

Despite that the uptrend seems healthy and has been stacking up flips of minor resistance levels into minor support levels at 1.3725 and 1.3692. The long bias needs to be maintained and the logical level of major support to look for a high-probability long entry remains the area around 1.3655 which is currently confluent with a broken and retested trend line and today’s S3 pivot point. This is also within the area where the current thrust up began, as can be seen in the chart below.

As the entry area is quite far away from the London open price, and as we have no important events before Noon London time, it is recommended not to be concerned with this trade before then. The ECB President’s words may trigger a movement worth taking with a touch trade.