GBP/USD Signal Update

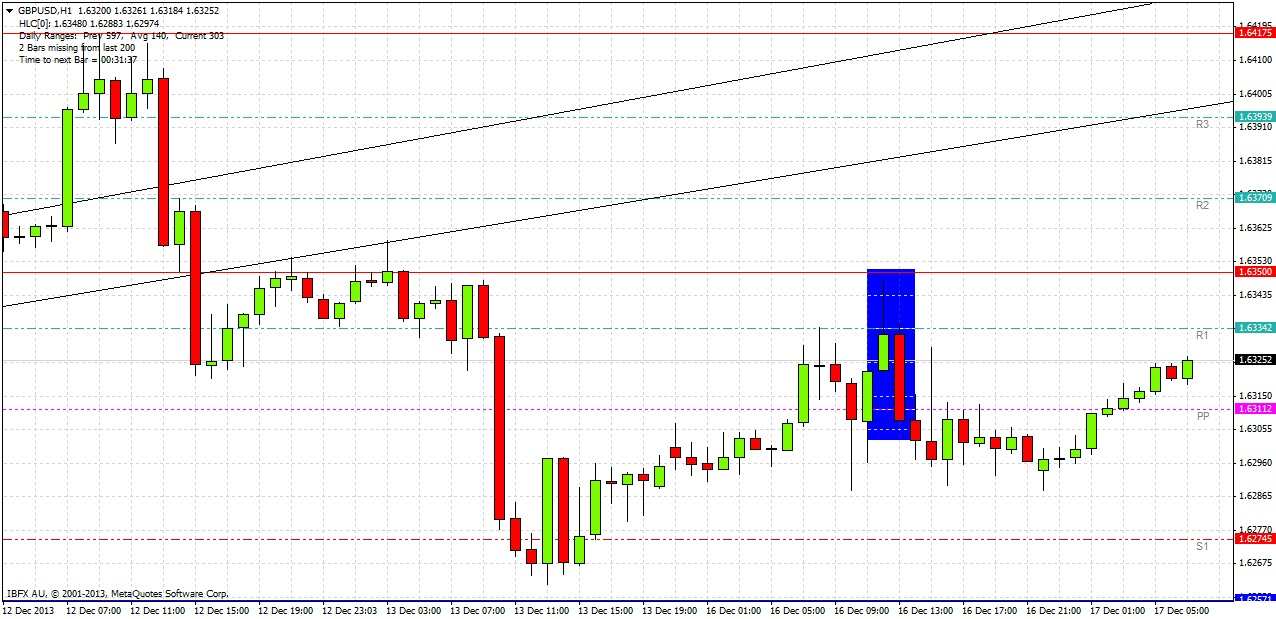

Several signals were given yesterday and one of them came within 2 pips of being triggered on my price feed: Short Trade 1 hourly bar rejecting 1.6350. Some brokers might have given 1.6350 and if that happened to you, you would have entered short on the break low of the engulfing bar that followed at 1.6307, as shown in the chart below. The problem is that the entry was really not supposed to be this low as 75% of the position was meant to be taken as profit as 1.6305! If you did end up taking this trade I hope it was clear to you to take the risk off as soon as possible, as the minor support I identified at around 1.6300 did hold and the price is now approaching the stop loss of 1.6336 or so.

Today’s GBP/USD Signals

Risk 0.50%.

Entry should be made before 5pm London time today only.

Long Trade 1

Enter a long touch trade by placing a limit order at 1.6230 with an initial stop loss at 1.6188.

Take profit on 80% of the position at 1.6250 and move the stop loss to break even.

Take half of the remainder of the position as profit at 1.6350 and then let the rest of the position ride.

Short Trade 1

Enter a short touch trade by placing a limit order at 1.6416 with an initial stop loss at 1.6456.

Take profit on 75% of the position at 1.6355 and move the stop loss to break even.

Take half of the remainder of the position as profit at 1.6260. Let the rest of the position ride.

GBP/USD Analysis

Major news is expected today for both GBP and USD. At 9:30am London time there is GBP CPI data and at 3:30 the Governor of the Bank of England is speaking. At 1:30pm London time there is core CPI for USD. Therefore today could see an active day for this pair with lots of movement.

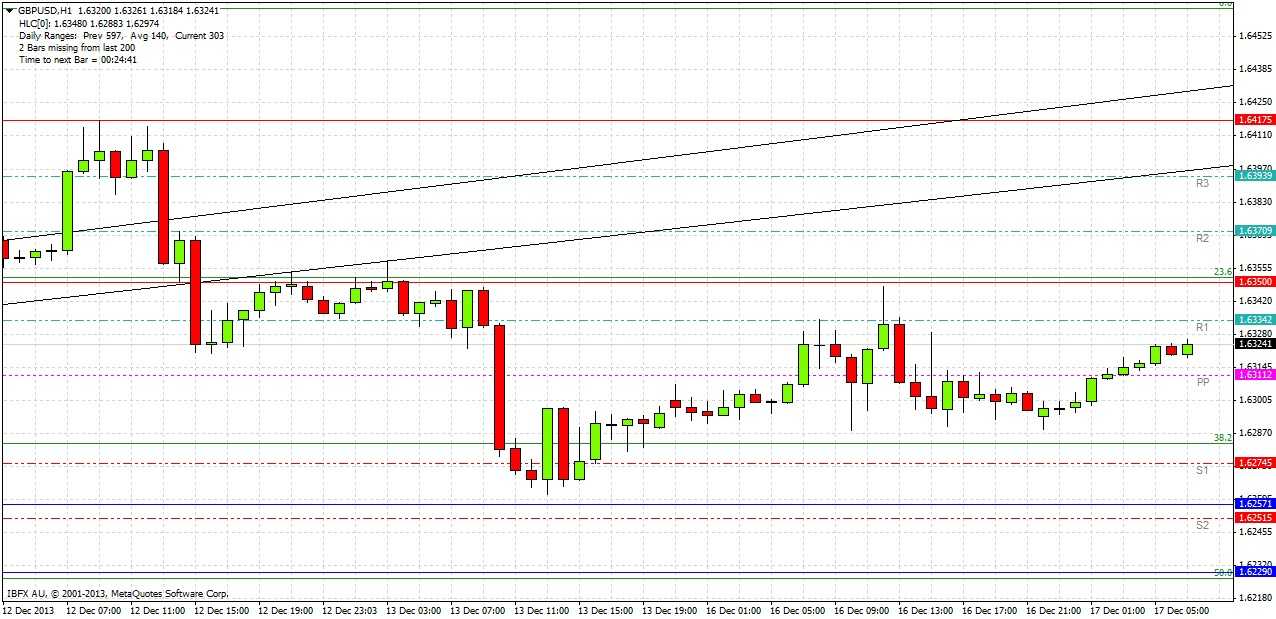

Yesterday was an inside day. The action on Friday and Monday was bounded almost to the pip by two S/R levels I identified previously: 1.6257 and 1.6350. As these levels have already had some impact, while they should still be noted and might still be effective, I am not looking at trades off these levels any more. The important levels that come into play now we have some news on both sides and an inside day yesterday which can be expected to break, are the further S/R levels of 1.6230 for a long and 1.6417 for a short. They are both far away from the current price action so should be touch trades taken without waiting for candlestick confirmation.

I see more potential on the bear side but I am taking no bias so see both long and short trades possible today.

1.6230 is the 50% Fibonacci retracement of the bullish trend line move up at 1.6230 which is also confluent with previous resistance. The level at 1.6417 has already acted as resistance, and was previously support. Today it should also be confluent with the recently broken bullish trend lines: