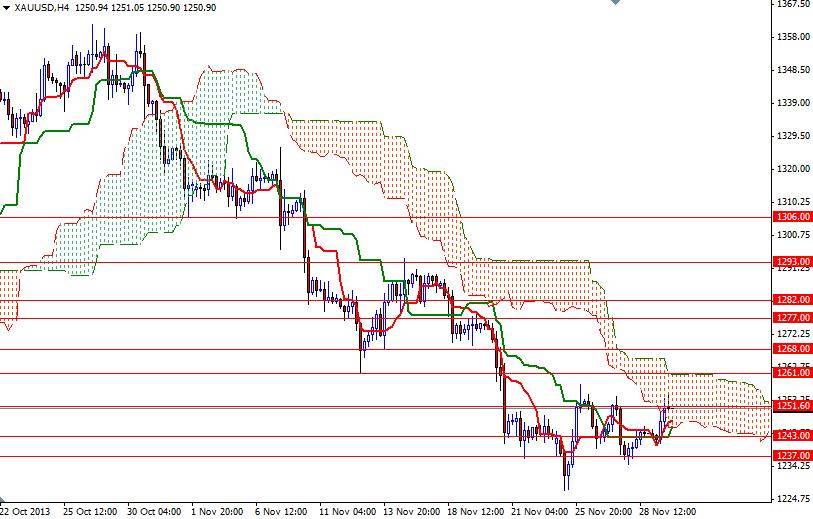

The XAU/USD pair posted first weekly gain in five weeks as market players started covering their short position prior to the U.S. employment data which will be released this week. Gold prices have been under a relentless selling pressure since we failed to climb above the 1353 resistance level where the Ichimoku clouds resided on the daily chart. From a technical point of view, trading below the Ichimoku clouds on the weekly and daily charts is highly negative for the XAU/USD pair. However, last week gold held in a tighter range, roughly between 1226 and 1258 and as I pointed out earlier chasing gold (before closing below 1237) might be risky at this point.

Although there is no sign of a major trend reversal, I expect prices to revisit the former support at 1268 at least. The first hurdle gold needs to jump is located around the 1261 level, the top of Ichimoku cloud on the 4-hour time frame. If prices break and manage to hold above the 1268 resistance level, we could see the pair extending its gains and climbing towards the 1293 - 1298 area.

Since this area converges with the Ichimoku cloud on the daily chart, it will be a pretty tough nut to crack. If the bears take the reins and prices start to fall, expect to see some support at 1243 and 1237. Closing below the 1237 support on a daily basis would indicate that 1225.50 may be tested soon after. A slew of key economic indicators will be released this week, including new home sales, ADP non-farm employment change, ISM manufacturing and services PMIs, but of course the highlight of the week will come on Friday when the Labor Department releases its employment report for November.