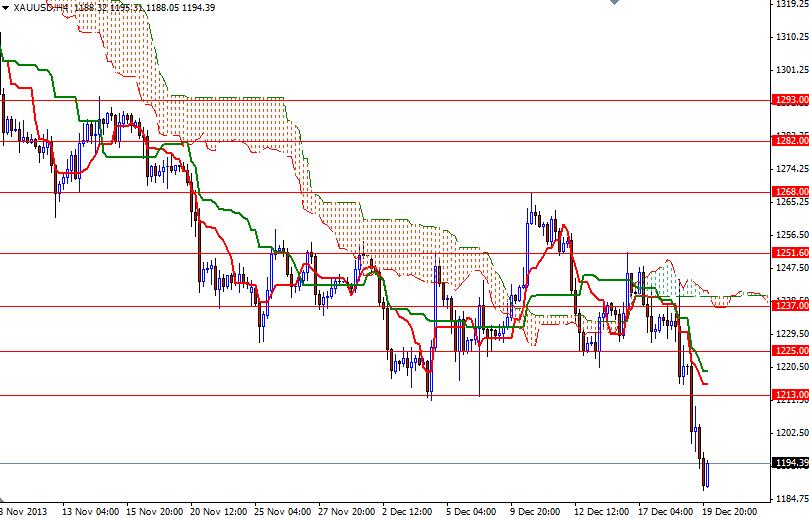

Gold continued to slide on Thursday and traded near the lowest level in six months as investors turned to the relative safety of the American dollar after the Federal Reserve announced that the era of massive stimulus came to an end. During yesterday's Asian session the XAU/USD pair tried to climb above the 1225 level but the bears stepped in and dragged prices below the 1200 support level.

Appetite for gold has been decreasing constantly as the conditions in the marketplace have dulled the precious metal’s safe-haven appeal. While we have bearish pressure from strong global equities markets, low inflation expectations worldwide and improving U.S. economic data, demand for the precious metal as an alternative investment will remain subdued. I think the XAU/USD pair will not be able to pull itself out of the bears' grip until significant demand comes from central banks and large financial institutions. However, we are approaching to a critical support at the 1180 level which had lured some serious buyers back in June and this level converges with the bottom of the descending channel on the daily chart.

Today the key levels to watch will be 1180 and 1200. If the bears continue to dominate the pair and push prices back below the 1180 level, there is little to slow this pair down until we reach the next support at the 1160 level. Below that, the next challenge will be waiting the bears at 1150 and 1138. If the pair finds support and climb above 1200, expect to see resistance at 1213 and 1225.