The XAU/USD pair fell to a 21-week low of 1217.68 after the U.S. manufacturing data, before recovering slightly to 1222.91. Data released from the Institute for Supply Management showed that the index of national manufacturing activity climbed to 57.3 from 56.4 a month earlier. Since market sentiment is ultimately driven by expectations of tapering, upbeat U.S. economic data are viewed as ramping up the possibility that the Federal Reserve would turn down the tap on its massive stimulus program within the next few meetings.

Now the real question is whether the November jobs data will come out strong enough to convince Fed policy makers. Honestly, I don't think that the Fed will pull the trigger at its December meeting. Besides, even Fed's policy makers may be uncertain about how to exit from the bond buying program. Of course that doesn't really matter because the XAU/USD pair has declined 27% since the beginning of the year - while the Federal Reserve maintained its aggressive asset purchases.

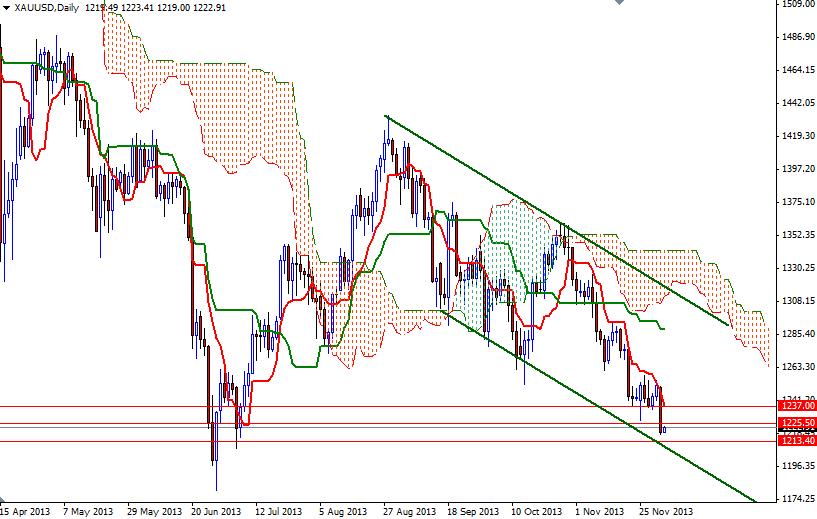

From a technical perspective, the key levels to watch will be 1225.50 and 1213. If the bulls take over and prices reverse, first challenge will be waiting at the 1225.50 level. If they can manage to push the pair above this resistance level, expect to see more resistance at 1237 and 1243.

As I mentioned last week, until prices climb above the Ichimoku clouds (at least on the 4-hour time frame), buying gold will be risky. If the bears continue to push downward and prices drop below 1213, I will be looking for 1207 and 1200. Once below 1200, there is little to slow this pair down until we reach the next key support at the 1180 level.