By: DailyForex.com

The XAU/USD pair (Gold vs. the American dollar) scored a gain of 1.7% on Wednesday as investors started to shift money from equities to gold. During yesterday's session gold prices initially fell to the lowest since July 5 but moved back up after the bulls managed to defend the 1213.40 support level.

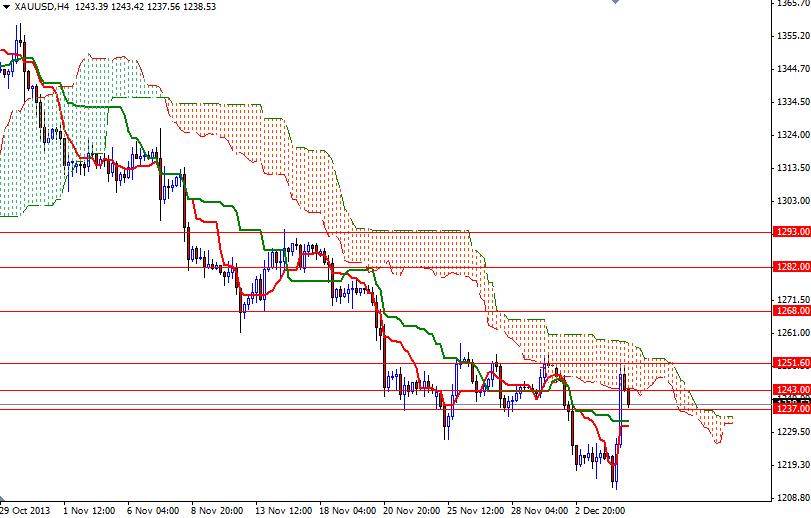

Recently, the price of gold has been continuously held in check by the key 1252 upside barrier/resistance, so in order to confirm that the bulls are dominant, I believe that a sustained break above this level which also converges with the top of the Ichimoku cloud (4-hour chart) is essential.

If the XAU/USD pair pulls itself out of the bears grip, it is likely that we will see the market testing the next strong resistance levels at 1268. Closing above the 1268 resistance could increase buying pressure and give the bulls a chance to march towards the 1293 resistance level. On its way up, expect to see some resistance at 1282.

Currently the XAU/USD pair is trading below the Ichimoku cloud and I see some support between 1237 and 1233. If this support is breached, I think the bears will be aiming for the 1225.50 level next. A drop below 1213.40 would place control back in the paws of the bears as we head towards the 1200 (or even 1180) support level. Market participants will pay close attention to weekly unemployment claims, U.S. GDP consumer price index and factory orders data due later today.