The XAU/USD pair (Gold vs. the American dollar) closed the day lower after three consecutive days of gains as the American dollar gained some strength on signs Washington policymakers are actually closer to reach an agreement on reducing the U.S. budget deficit. The XAU/USD pair had extended its gains and jumped to a three-week high on Tuesday after the bulls managed to break through the 1252 resistance level.

The Federal Open Market Committee had decided to delay tapering its quantitative easing program in September because of a fiscal concern, so people are starting to think that the budget agreement in Congress will give the Federal Reserve confidence to pull the trigger at its December 17-18 meeting. However, yesterday's price action suggests that the gold market has pretty much priced in a modest taper. The reduction of asset purchases may be the catalyst that the bears need to push gold prices lower but this could also lead some investors to abandon stocks and flock to gold ahead of the Fed meeting.

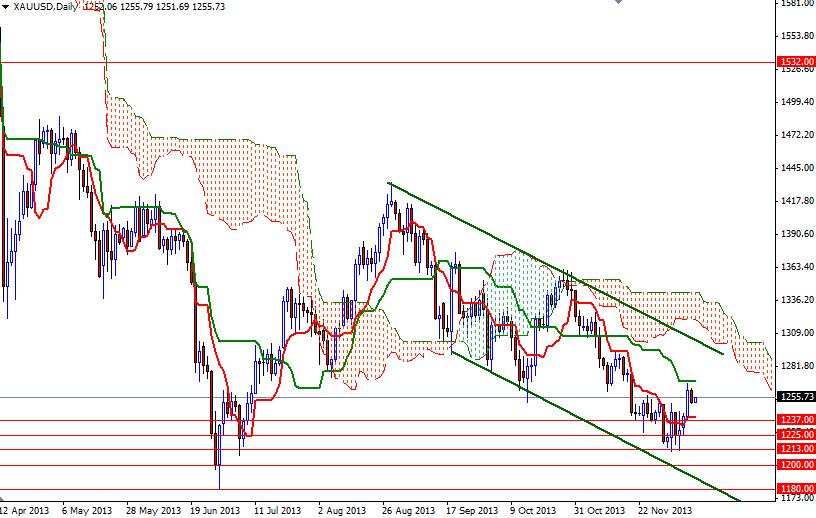

Speaking strictly based on the charts, it seems that there is still some room for the pair to run higher in the short term. During today's Asian session the XAU/USD pair is testing the 1251.60 support level as expected and if this support holds, the bulls might have another chance to tackle the 1268 resistance level. If the pair penetrates that barrier, we will be heading towards 1298. On its way up, expect to see resistance at 1282 and 1293. In order to gain some strength, the bears will have to drag prices below the 1248 level. If that is the case, I think we will see the pair pulling back to the 1240 - 1237 area. Closing below the Ichimoku cloud on the 4-hour chart would shift things to the bears once again.