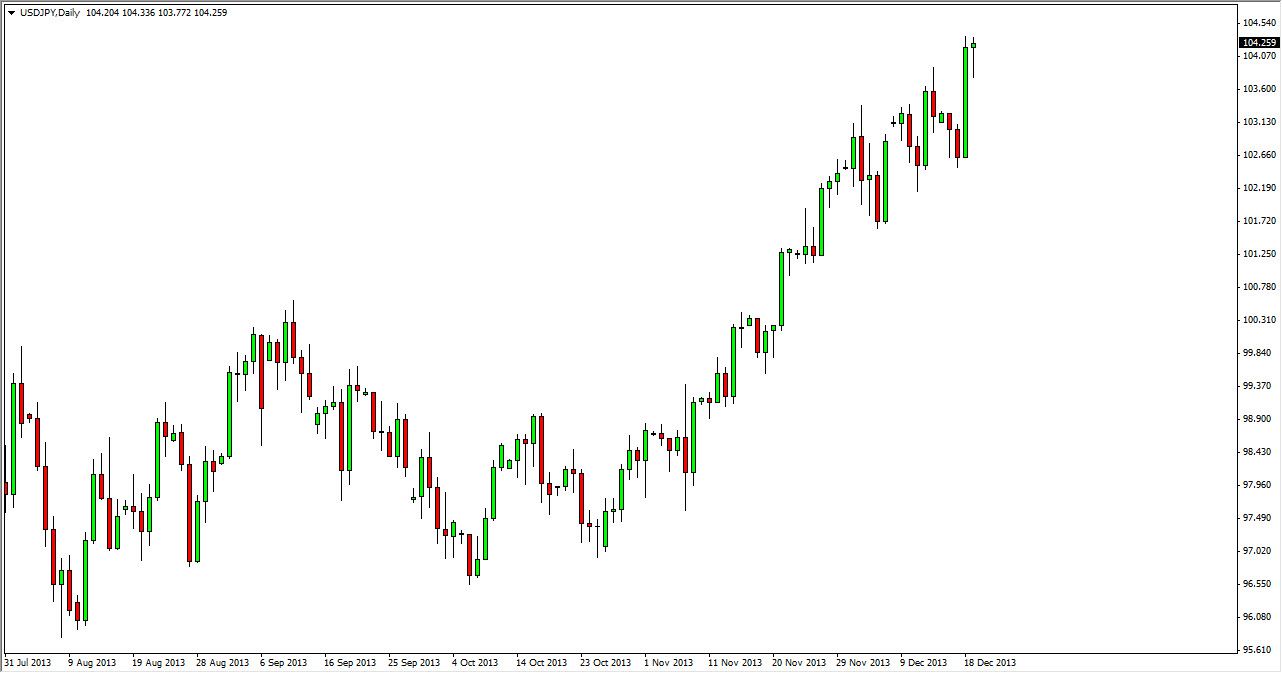

The USD/JPY pair initially fell during the session on Thursday, but as you can see bounce off of the wider for region in order to form a nice-looking hammer. This hammer as the top of a long uptrend, so therefore I feel that the market continues to show bullish strength and we should hit the 105 level relatively soon. I believe that this market is beginning a multi tier long-term uptrend, so therefore this fits nicely with my previous pieces.

The 105 level will eventually be broken to the upside as we then will and for the 108, and then the 110 levels. Expect pullbacks to be nice buying opportunities as the two central banks are diametrically opposed at the moment. The Federal Reserve of course is starting to taper off of quantitative easing, although they have noted that interest rates will remain low for a longer period of time than originally thought. However, the Bank of Japan has just started to implement even looser monetary policy, so therefore the Yen should continue to depreciate over the longer term.

This is the type of move the careers are made of.

This pair continues to look extraordinarily bullish, so I see absolutely no reason to sell it. In fact, I believe that adding to the position every time we pullback will be the way to go, as I intend on having a massive sized position as time continues to march forward. I do think from time to time we may have a couple hundred pips worth of a selloff, but those should all be excellent buying opportunities and paying attention to the weekly charts will keep you somewhat honest as far as keeping the right direction going.

Until the Bank of Japan looks to changes monetary policy, or if the Federal Reserve certainly announces some type of expansion of its quantitative easing, I don’t see any way this pair can drop for a significant amount of time. This is a simple “buy on the dips” type of market again, just as it was before the financial crisis hit.