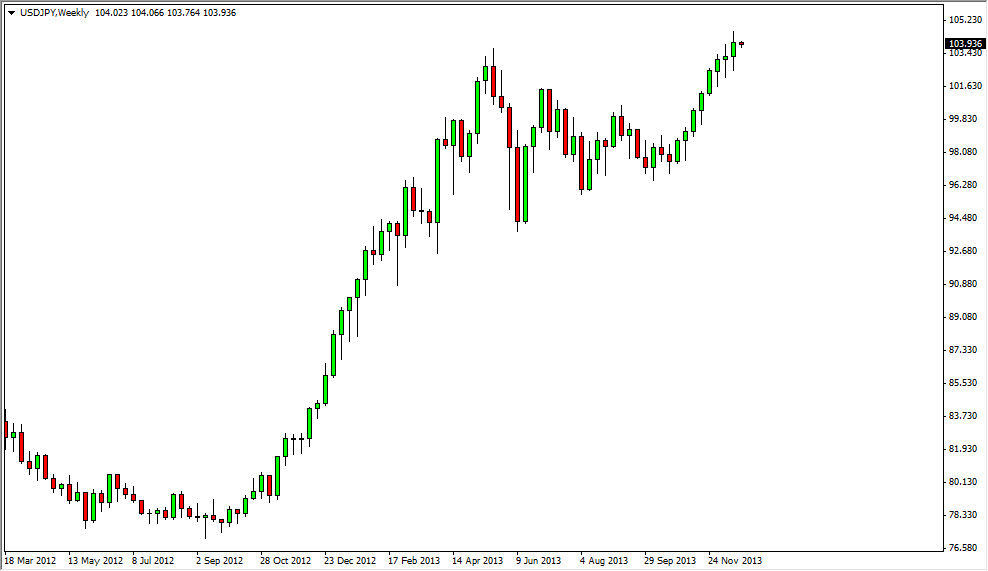

The USD/JPY pair has been going higher for a couple of months now. While a pullback certainly could happen, I believe that this pullback would simply be an opportunity to start buying again. Because of this, I have absolutely no interest in selling this pair at all. On top of that, with another nonfarm payroll number coming up, if we get a reasonably strong wind that could really accelerate the move higher.

The Bank of Japan is looking to keep the value of the Yen low, so they obviously are not going to be any type of concern in this market. They really don’t become part of the conversation until the market pulls back significantly, something that I do not see happening anytime soon. If you look at the shape of the candles over the last three weeks on this chart, you can see that there are long wicks, meaning that although the velocity of the move has started to wane a bit, we still have buyers stepping into the marketplace every time the market drops just a little bit.

Nonfarm payroll numbers

Obviously, the nonfarm payroll numbers will become paramount this month as we determine whether or not the move higher is going to accelerate. However, keep in mind that there are also other numbers to pay attention to. GDP came out much higher than anticipated just a few sessions before Christmas, and we also have to pay attention to the ADP employment numbers, as well as First-Time Unemployment Claims. If those continue to go down, that could show that the labor market is picking up even more so in the United States, and thereby gives the Federal Reserve more room to begin to taper off of quantitative easing. If that happens, this trade suddenly becomes a long-term move higher. Quite frankly, I think it already is, but we need that one last catalyst to make sure for those who still are a bit nervous going long of this market. I for one am already long of this market, and plan to be for a couple of years.