USD/JPY Signal Update

Tuesday’s signals were not triggered and expired.

Today’s USD/JPY Signals

Risk 0.25% on any trade.

Entry should be made only between 9pm tonight and 8am tomorrow morning London time.

Long Trade 1

Enter long at the next bar break of an hourly pin or strong outside bar rejecting and closing above 102.21. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips below it, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing low or 101.88, depending upon how close the entry is to 102.21. If the entry is very close, then the lower of the two should definitely be used.

Take profit on 75% of the position at 102.64 which should be quite close to the (by then) broken lower bullish trend line, move the stop loss to break even, and take half again at 103.00 and then half again at 103.37, leaving the rest to ride.

Long Trade 2

Enter long at the next bar break of an hourly pin or strong outside bar rejecting and closing above 101.65. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips below it, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing low or 101.20, depending upon how close the entry is to 101.65. If the entry is very close, then the lower of the two should definitely be used.

Take profit on 75% of the position at 102.10, move the stop loss to break even, and take half again at 102.98 and then half again at 103.30, leaving the rest to ride.

Short Trade 1

Enter short at the next bar break of an hourly pin or strong outside bar rejecting and closing below 103.37. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips above it, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing high.

Take the risk off the trade at 103.01 and take half of the position as profit at 102.30.

Short Trade 2

Enter short at the next bar break of an hourly pin or strong outside bar rejecting and closing below 103.81. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips above it, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing high.

Take half of the position as profit at 103.01 and half of the remainder of the trade at 102.30.

USD/JPY Analysis

No major data is expected today for the JPY. At 1:30pm there is USD Building Permits data. Most importantly, at 7pm London time there is an FOMC statement and projections that are eagerly awaited by the market and which are likely to strongly affect the USD.

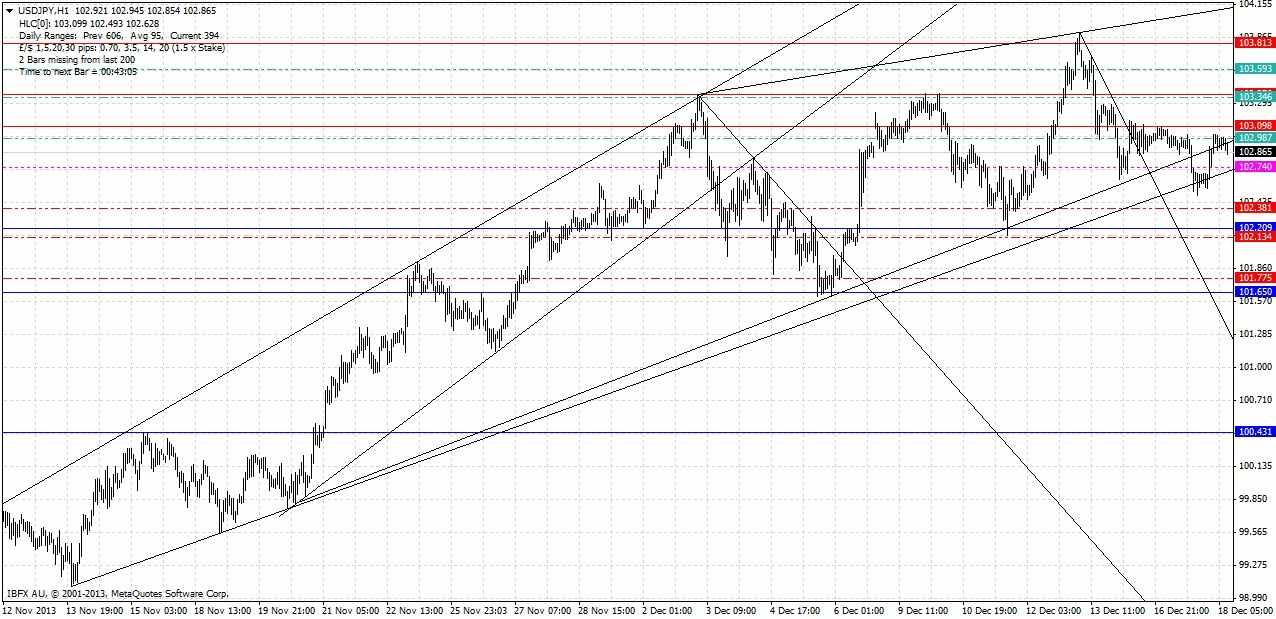

As mentioned yesterday, the lower trend lines of the well-established bullish channel are starting to look shaky, with two hourly closes below the lower trend line as can be seen in the chart below:

The price also printed another support turned resistance level above at 103.10. Nevertheless it does not look so firm to me. However, do be aware that the level of 103.37 is confluent with both of the previous tops in the double top and today's R2 daily pivot point; it also acted as minor support late last week.

Everything will hinge on the outcome of the FOMC’s statement and press conference much later, therefore it is not recommended to enter any trade until at the earliest 9pm London time this evening. There may be wild volatility. If the result is a strengthening of the USD, we are technically poised for it as the lower trend lines look so shaky. I have no bias.

Here is a zoomed-out version of the chart so the bigger picture can be seen: