Risk 0.50%

Entry should be made between 2pm today and 8am tomorrow London time only.

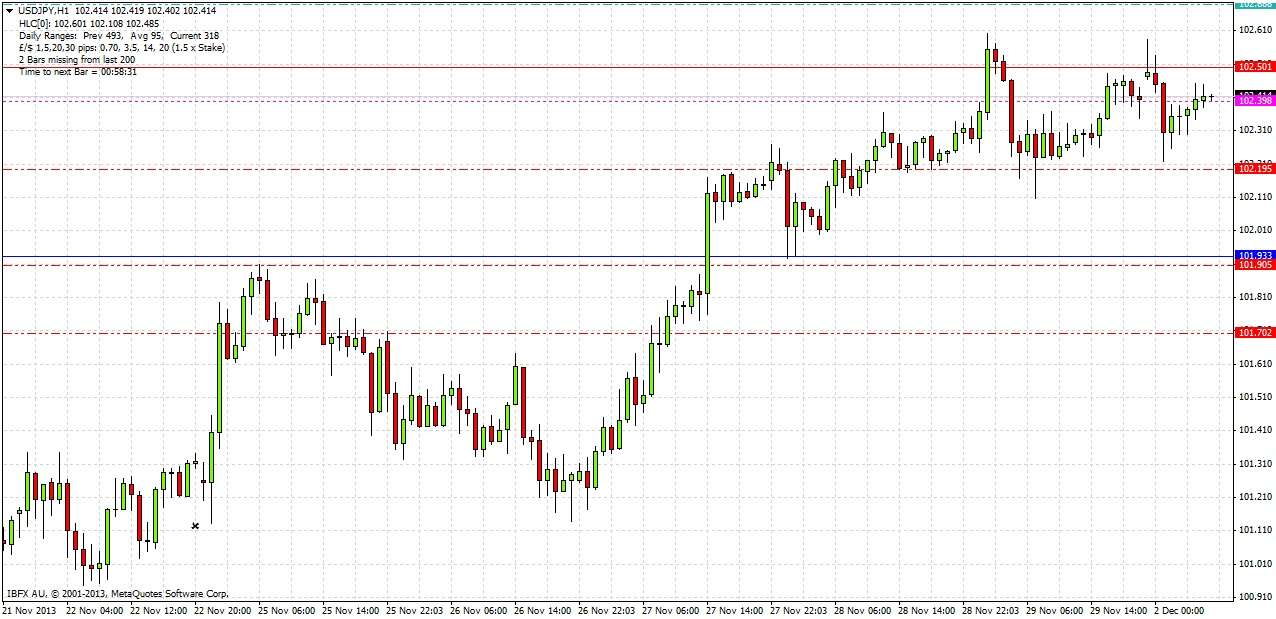

Enter only after a next bar break of a confirming pin bar, engulfing bar or strong outside bar rejecting the 101.90 level. If the level is already firmly broken to the down side by 2pm London time, there is no trade.

Stop loss at 101.60.

Move stop loss to break even and take half the position as profit when the price reaches 102.35.

USD/JPY Analysis

Bernanke is speaking at 1:30pm London time which may cause sharp moves; therefore the trade should only be entered after he has been speaking for at least half an hour.

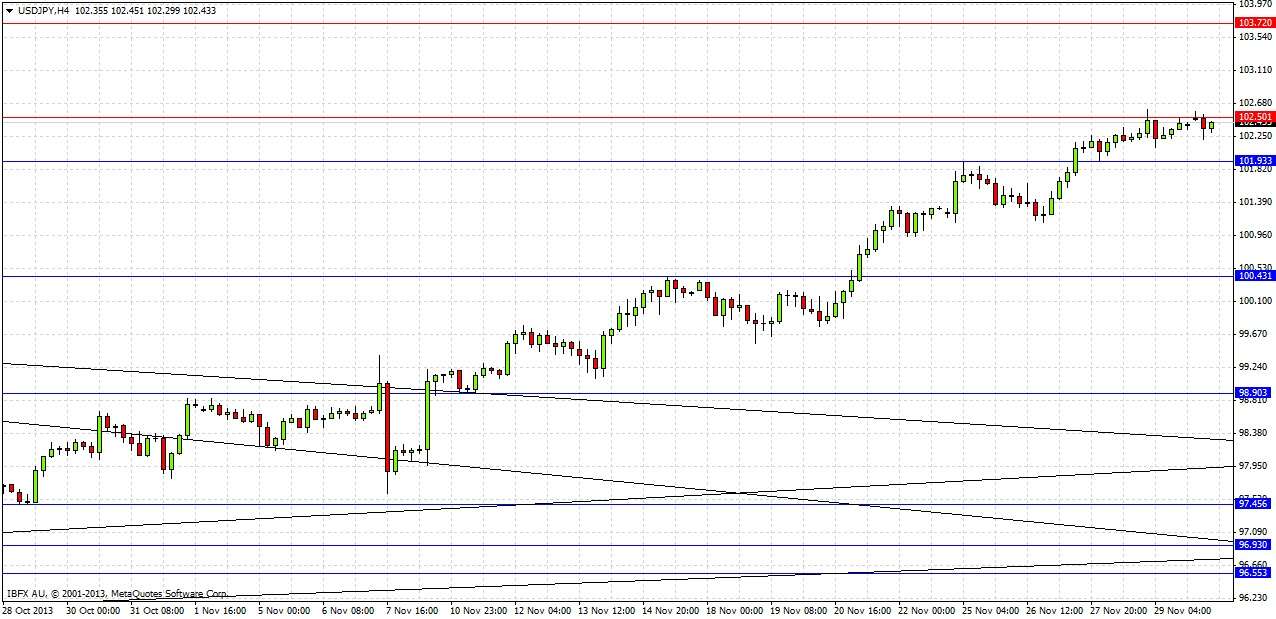

The pair has been in a strong uptrend since early November, when it broke very bullishly out of its restraining triangle. It broke strongly upwards through some quite well-established resistance levels. Last week it briefly broke the key level of 102.50, but was unable to rise, and formed a double top at this level last night, although it is really too soon to call this a double top. The long-term high of 103.72 is still quite a way above us, and the uptrend is intact:

The chart above shows key S/R levels and the triangle trend lines.

Although the chart is showing a possible double top at the key level of 102.50, the strong bullish trend and the confluent level at 101.90 of resistance turned into support and the GMT S2 pivot suggest a long trade off a pull back to this level.