USD/JPY Signal Update

Thursday’s signal was not triggered and expired.

Today’s USD/JPY Signals

No signal is given for today.

USD/JPY Analysis

No important news is expected today for either the JPY or the USD. As this is the week of the Christmas holidays, the market should be expected to be very thin and flat today and tomorrow. Additionally, today is a public holiday in Japan.

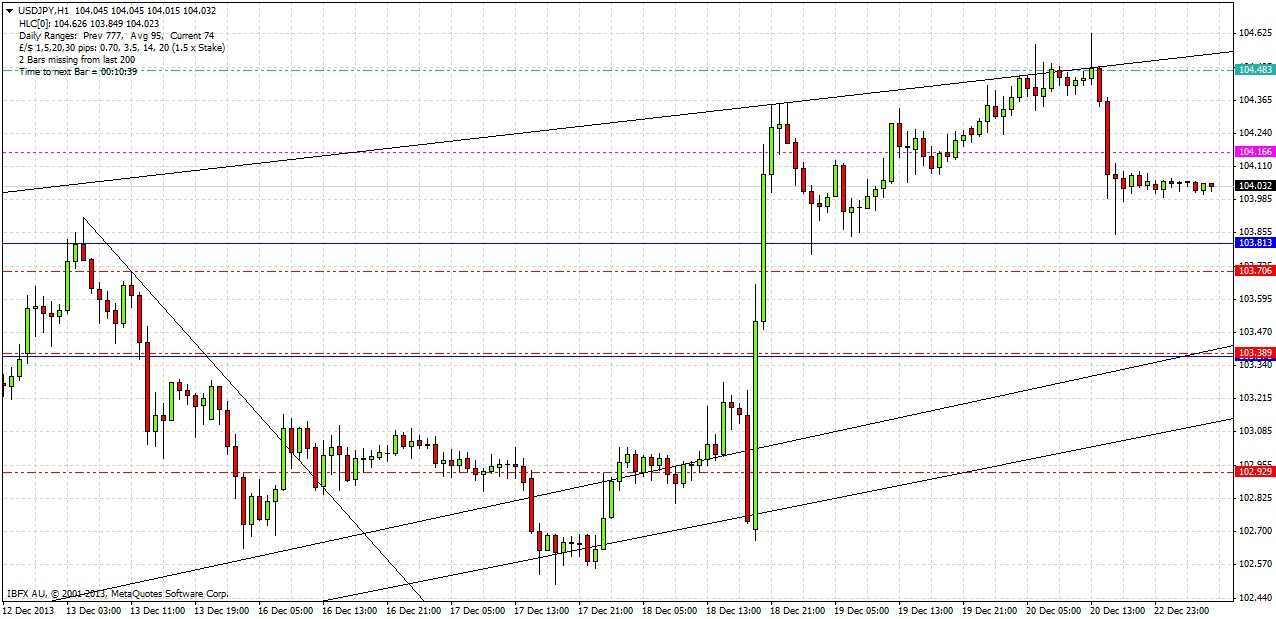

Last Thursday I was looking for a pull back within the latest bullish push following the FOMC statement last week to 103.37. At the time of the publication of the last signal, the price was testing 103.82 which I did not want to take, however it held and gave about 80 pips gain, reaching a new 5-year high of 104.62 on Friday.

Readjusting the upper channel trend line to account for the highs on 18th December produced a new trend line which held on Friday, with no hourly candle managing to close about the channel’s upper trend line, as shown in the chart below:

The price ended up falling last Friday to within just a few pips of the support level at 103.82, quickly rising 20 pips or so and stabilizing.

The market now is extremely flat and quiet as can be expected. I really do not see any trading opportunities for today’s session.

Nothing has really changed from last Thursday. The support levels are still intact below us and we are still in a bullish channel which is holding pretty firmly at both ends.