USD/JPY Signal Update

Yesterday’s signal was not triggered and expired.

Today’s USD/JPY Signal

Risk 0.50%

Entry should be made between 8am today and 8am tomorrow London time only.

Enter at the first to occur only after a next bar long break of a confirming pin bar, engulfing bar or strong outside bar as follows:

Long Trade 1

Enter long after confirmation bar touching support level at 102.59, ideally with lower wick touching in confluence with the lower channel trend line and the S1 GMT daily pivot point.

Stop loss just below the lower of the local swing low or 102.30.

Take 75% of the position as profit at 102.99.

Long Trade 2

This trade to be taken only if price falls through the support level at 102.59 without any pull back.

Enter long with a limit order at a touch of 101.95.

Stop loss at 101.67.

Take profit on 50% of the position at 102.50.

USD/JPY Analysis

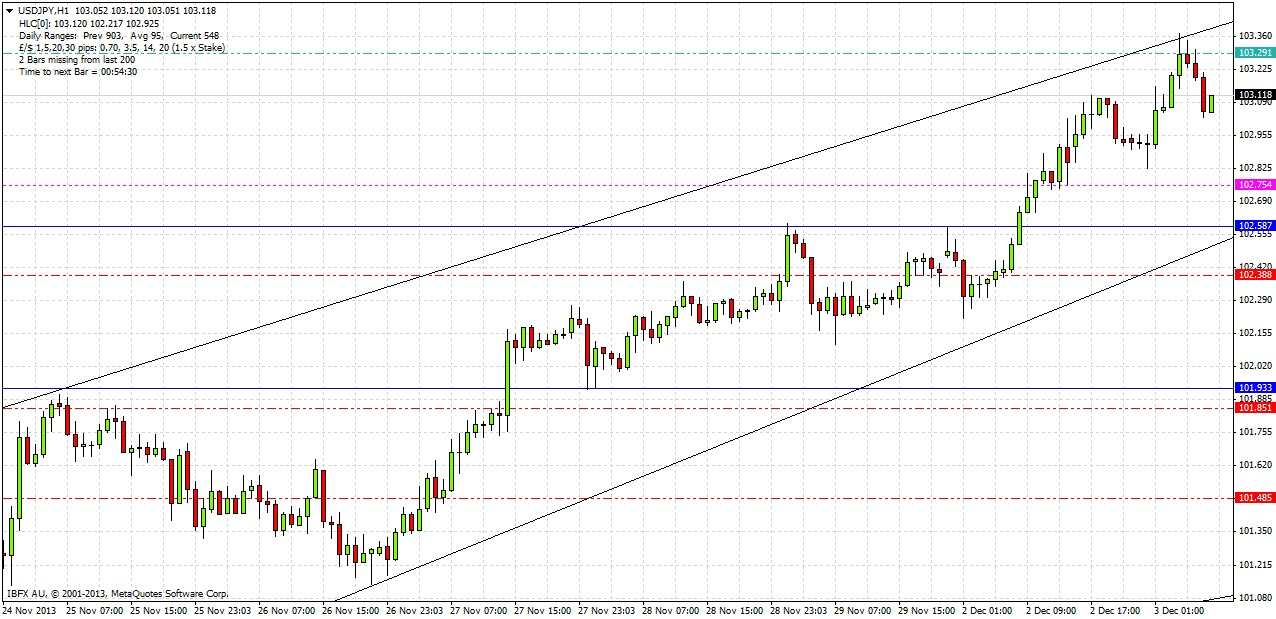

There are no important news items due before the signal expires tomorrow for either the USD or the JPY, so it may be a quiet period for this pair after its extended upwards move that peaked at 103.37 a few hours ago.

We were correct yesterday in taking a bullish bias, but unfortunately there was no pull back to trigger the long signal.

The pair has been in a strong uptrend since early November, when it broke very bullishly out of its restraining triangle. It broke strongly upwards through some quite well-established resistance levels. There is long-term resistance overhead at 103.72; however of more immediate interest is the second touch of the upper channel trend line that has been established since just after the breakout from the triangle in early November:

The channel is steep and so we are not looking at any short trades yet, at least not until the lower channel trend line is broken and retested from the other side. Despite that, due to the strength of the upwards trend, over the next 24 hours we are interested only in looking at the next possible long trade off 101.95.

The chart below provides a closer look at key support levels and the channel trend lines: