Today’s USD/JPY Signal

Risk 0.25%.

Entry should be made before 5pm today New York time.

Long Trade

Enter long at the next bar break of an hourly pin or strong outside or engulfing bar rejecting and closing above 104.64. If this level is not touched and rejected by the same hourly bar, or if an hourly bar closes more than a few pips below it, the trade is immediately invalidated and should not be taken.

Stop loss at the local swing low or 104.48, depending upon how close the entry is to 104.64. If the entry is very close, then the lower of the two should definitely be used.

Take profit on 75% of the position at 104.99, move the stop loss to break even, and leave the rest to ride.

USD/JPY Analysis

There is important news today for the USD at 3pm (Pending Home Sales) London time which might move this pair.

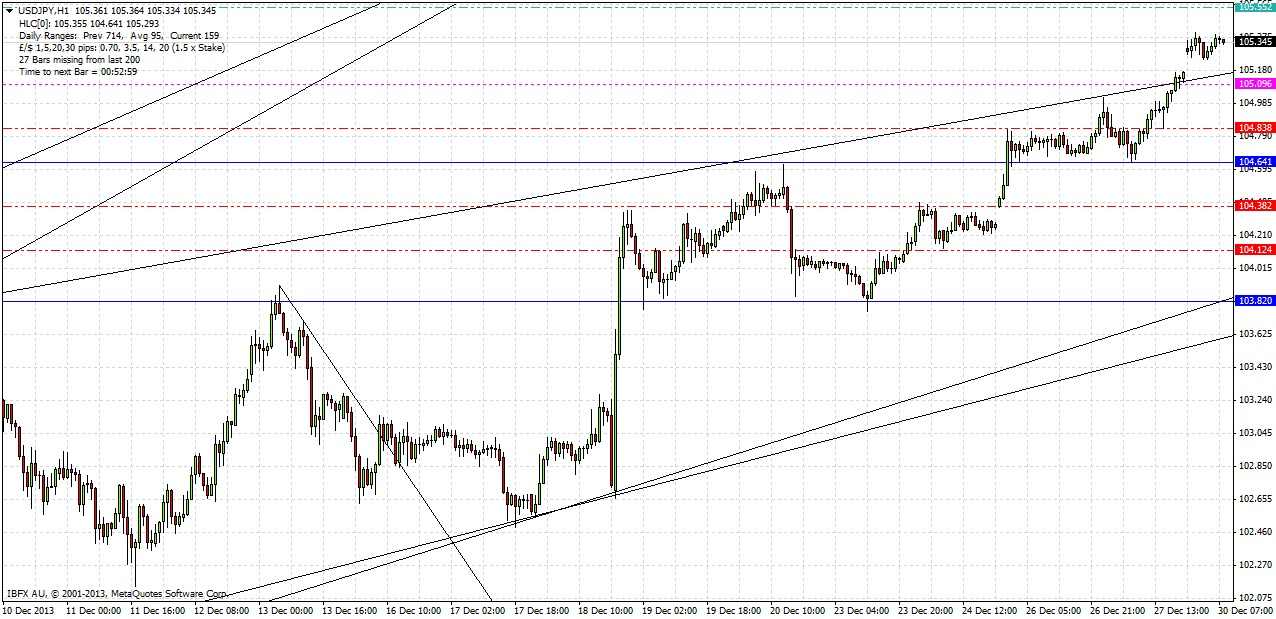

The wonderful uptrend in this pair was maintained over the Christmas period with bullish trend lines holding and new support levels being established at 103.82 and 104.62. The upper channel trend line was breached to the upside twice, the psychologically key level of 105.00 was broken to the upside, and new 5-year highs were made. All in all there is every reason to be bullish and take a long bias. I do not see any significant resistance levels before 106.38:

Here is a zoomed-out version of the chart so the bigger picture can be seen: